技术赋能,精准理赔——2025新能源理赔技能提升培训圆满收官

Technology Empowerment, Precision Claims——2025 New Energy Vehicle Claims Skills Enhancement Training Successfully Concludes

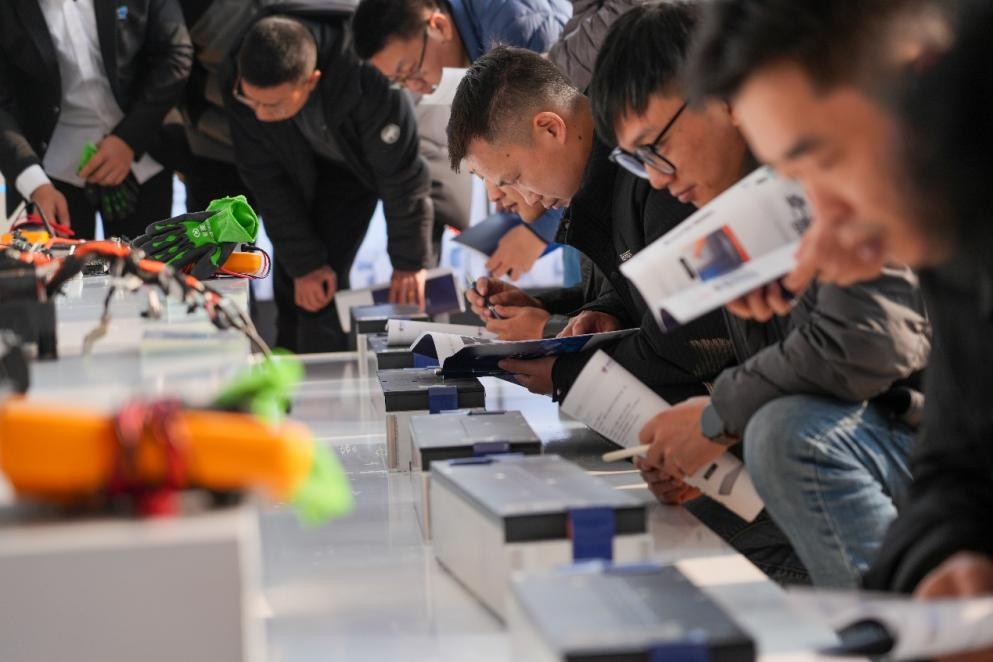

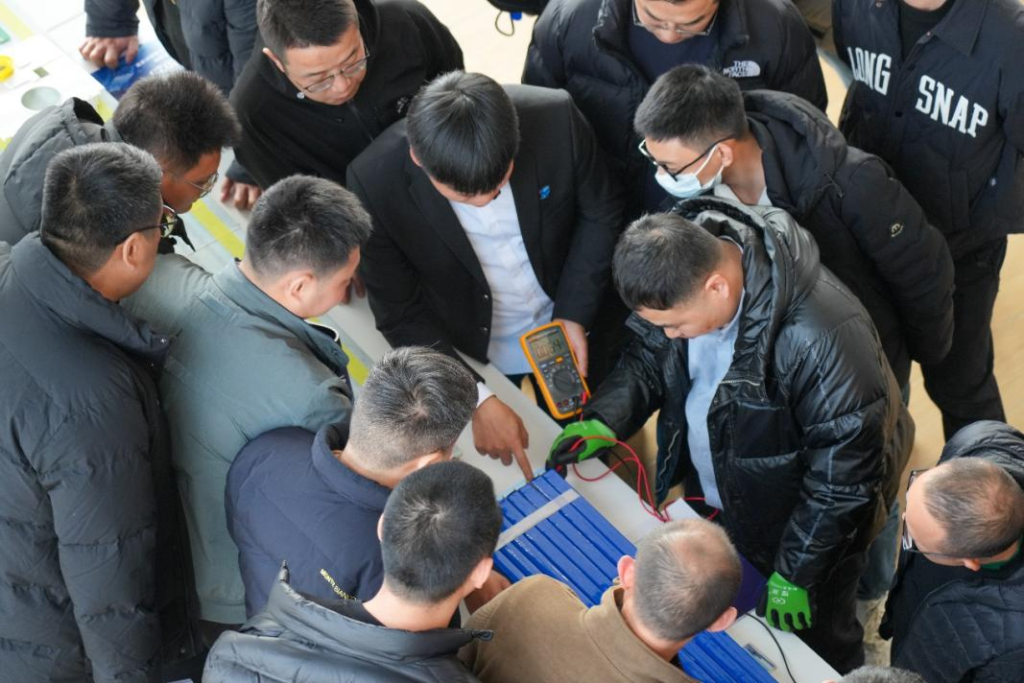

在新能源汽车渗透率突破40%的行业背景下,理赔工作正面临风险复杂化与技术门槛提升的双重挑战。为积极应对变革、夯实专业能力,理赔管理部于2025年12月17日至19日在成都举办“技术赋能·精准理赔”新能源理赔技能提升专项培训。本次培训采用“理论精讲+实操沉浸”双轨模式,为全国各机构新能源理赔专家提供了一场系统深入的学习之旅。

培训内容紧密围绕理赔实战核心难点展开,涵盖CTP灌胶电池维修工艺、新能源水淹车判定、高价值配件定损、高压安全操作、BMS数据解析及电池定损证据链构建等关键课题,旨在推动理赔作业从“传统经验”向“数据与标准”转型。

理论课程聚焦技术前沿与风险防控,深入解析灌胶工艺对电池安全的影响,并结合真实案例拆解欺诈识别要点。实操环节则注重动手能力与场景应用,学员通过拆解电池包、使用专业工具检测高压部件、模拟水淹车判定等训练,全面提升对复杂案件的技术研判与现场处理能力。

培训全程贯穿高强度实操与考核,学员在互动演练中展现出高度的专注与钻研精神,实现了学习成果的有效转化。公司首席理赔与客服官阳勇在总结中强调,理赔团队必须保持危机感、持续学习,夯实技术根基,推动作业流程向数据化、标准化、专业化发展。他勉励全体学员以培训为新起点,将所学转化为实战能力,成为理赔技术专家与公司新能源战略落地的坚实支撑,以专业服务赢得客户与市场的长期信赖。

本次培训标志着公司在新能源车险理赔专业化建设上迈出坚实一步,为应对未来行业挑战奠定了重要基础。

Amid the industry landscape where the penetration rate of new energy vehicles surpassed 40%, claims handling is facing dual challenges of increasing risk complexity and rising technical demands. To proactively adapt to changes and solidify professional capabilities, the Claims Management Department held the “Technology Empowerment · Precision Claims” New Energy Vehicle Claims Skills Enhancement Special Training in Chengdu from December 17th to 19th, 2025. This training adopted a dual-track model of “theoretical lectures + hands-on immersion,” providing a systematic and in-depth learning journey for new energy claims specialists from branches nationwide.

The training content closely focused on core practical challenges in claims handling. It covered key topics such as CTP Potting Process Repair Techniques, Water Ingress Judgment for New Energy Vehicles, High-Value Component Loss Assessment, High-Voltage Safety Operations, BMS Data Analysis, and Evidence Chain Construction for Battery Loss Assessment. The aim is to drive the transformation of claims operations from relying on “traditional experience” to being guided by “data and standards.”

The theoretical sessions focused on technological frontiers and risk prevention, delving into the impact of potting processes on battery safety and deconstructing key fraud identification points using real-world cases. The practical sessions emphasized hands-on skills and scenario application. Through exercises such as disassembling battery packs, using professional tools to test high-voltage components, and simulating water ingress judgment, participants comprehensively enhanced their technical judgment and on-site handling capabilities for complex cases.

The training was designed with a strong emphasis on hads-on practice and outcome evaluation. Participants demonstrated high level of focus and rigorous engagement during interactive drills, effectively translating learning into outcomes. In his concluding remarks, Mr. Yang Yong, the company’s Chief Claims and Customer Service Officer, emphasized that the claims team must sustain a sense of urgency, commit to continuous learning, solidify its technical foundation, and drive the development of operational processes towards being more data-driven, standardized, and professional. He encouraged all participants to use this training as a new starting point, transforming their acquired knowledge into practical capabilities, becoming technical claims experts and a solid pillar supporting the implementation of the company’s new energy strategy, ultimately winning the long-term trust of customers and the market through professional service.

This training marks a solid step forward in the company’s specialization development for new energy vehicle insurance claims handling, laying an important foundation for addressing future industry challenges.