循环救地球,安盛在行动

CR Week Story: AXA Recycles to Save the Future of Our Planet

每年的9月20日至24日是集团的 “安盛筑爱在行动周”。去年,我们作为安盛全球健步走接力赛的首发部队,首次加入 “安盛筑爱在行动”全球志愿者活动组织,自此,安盛全球人道主义援助的光谱,也汇入了我们的光束。

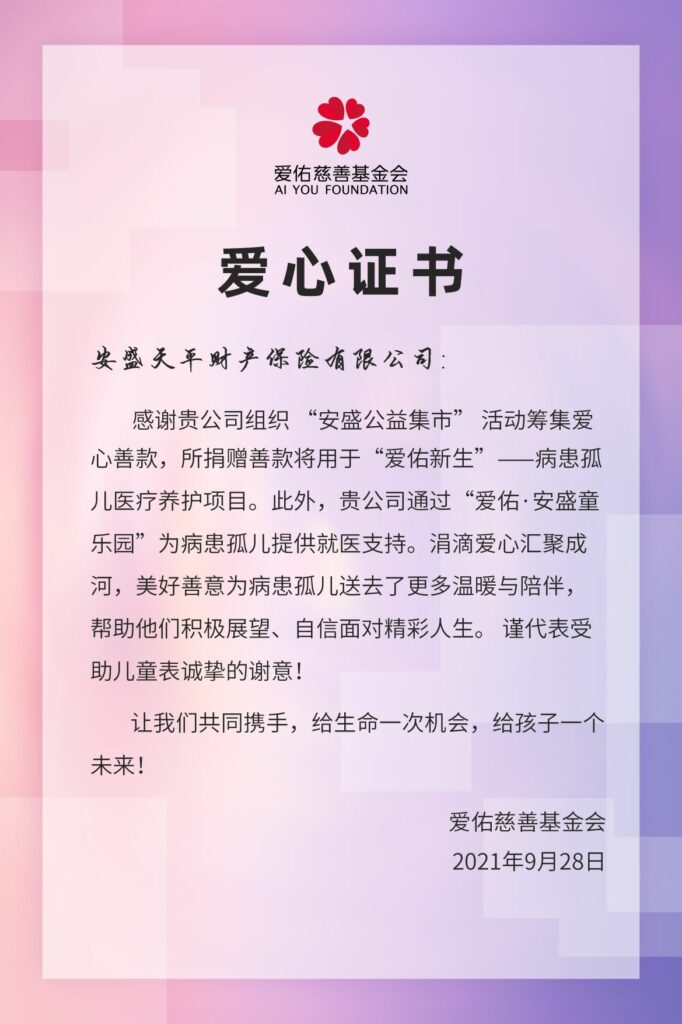

今年应环保主题,我们邀请了所有同事参与到为期一周的“循环救地球”挑战赛中,很开心看到大家热情参与,积极反馈,用微小的行动向地球传递正向信号。9月24日下午,首届安盛公益集市在瑞明职场开张。短短一小时内,在100多件员工捐赠的宝贝中成交52件,筹得的5048元善款已直接赠予“爱佑·安盛童乐园”,帮助罹患重疾的孤儿。

我相信,环保和公益可以成为我们的一种生活方式,一种生活态度。这是一种润物细无声的力量,可以让绿意生机和温暖爱意在地球上薪火相传,生生不息。

Each and every year, from 20 September to 24 September, Group catalyzes all CSR efforts by mobilizing all AXA employees around solidarity actions, to which we have joined through a world relay challenge in 2020.

In a world where climate protection has been prioritized more than ever, we therefore gave our pledge for a “RECYCLE for the Future of Our Planet Challenge” this year. I am so glad to see so many of you participating with enthusiasm, sharing your positive energies to the world by taking actions within your power. I would like to thank you all again for being a part of the first charity flea market of the company ever on 24 September. 52 items out of more than 100 donations were sold out within one hour after when the market was open, collecting a total amount of 5048 RMB thanks to our employees with philanthropic passion, donated directly to “Aiyou x AXA Children’s Playroom”.

It is in my belief that everyone has the capability, invisible and yet powerful, to protect the planet, though not one-off actions but rather, ongoing and continuous efforts.