CEO 寄语

亲爱的安盛天平同事,

溽暑盛夏,在7月的尾巴,第二届中国国际消费品博览会在经历过疫情重重的挑战后终于成功展开。这次安盛亮相消博会适逢法国担任主宾国,我们很高兴在法国国家馆向世界展示安盛,让更多人看到我们的自信风采。我们有幸参与当中,借助这个盛会的难得契机加深了与海南政府以及韦莱韬悦等伙伴的战略合作,与法国商务投资署、世界银行国际金融公司等各界有识之士交流可持续发展议题收获良多,让海南之旅满载而归。

这次活动最大的意义,是标志着安盛在华开启ESG元年。绿色转型不仅可能为公司未来业务发展带来难得机遇,更事关全人类命运与福祉。如何将安盛全球的先进技术与经验优势在国内推广落地,以保险+科技+场景运用打开金融业应对气候变化的局面,助力中国实现可持续发展,实现双碳目标,这是我们公司上下都需要深思钻研的课题。

展望未来,我们将再接再厉,贯彻集团的ESG理念与目标,兑现“守护生命之本,践行人类进步”品牌承诺,在中国有序推进各项ESG举措。希望各位在阅读本期月刊后对我们在ESG方面的理念与进展有更多了解。

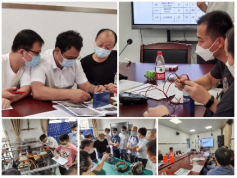

在八月初,我也很高兴在员工大会上与大家共同回顾以“多元产品、品质把控、持续发展”为特征的3.0转型近半年来的重要进展。上半年尽管受到疫情影响,但我们各个业务线仍然取得了高于预期的业务增长,录得几年来中国会计准则下的首次盈利。更重要的是,我们在机构转型之路上稳步迈进,成绩优秀!这是我们大家一起共同奋战的结果,值得我们为自己鼓掌!

下半年,希望我们乘胜追击,保持扭亏为盈的势头,同时加强“合规文化”建设,保持良好的总分联动,持续深化转型。不平凡的上半年里,我们携手跨越了一座小山峰,接下来,让我们团结协作,继续勇攀高峰!

欢迎点击观看安盛天平转型之路视频:

(供中国大陆区以外同事观看,For AXA colleagues outside mainland China)

CEO Message

Dear AXA colleagues,

The 2nd China International Consumer Products Expo (CICPE) was successfully held in July despite the challenges of the epidemic. We are delighted to showcase AXA to the world at the French pavilion. We are fortunate to be part of this event because it was a precious opportunity for us to cooperate strategically with the Hainan government and partners like Willis Towers Watson. We also exchanged ideas on sustainable development with knowledgeable and international organizations such as Business France and World Bank, making the Hainan trip much more eventful and meaningful.

This event marks the beginning of the new era of ESG for AXA China. Green transformation not only brings wonderful opportunities for the company’s future business development, but it also relates to the fate and well-being of all mankind. Promoting the advantages of AXA’s global advanced technology and experience to the domestic market, leading the financial industry to address climate change through insurance + technology + scene, helping China to achieve sustainable development, and achieving dual carbon goals are the topics our entire company need to study and think about.

We will continue to look ahead and make effort to implement AXA’s ESG initiatives and objectives. While achieving our brand commitment of “safeguarding lives to improve human progress”, we will introduce ESG initiatives in China step by step. Through reading this issue of our monthly newsletter, we hope you can gain a better understanding our ESG initiatives and progresses.

I am pleased to see you all at the staff meeting at the beginning of August. We reviewed the important progress we made in the 3.0 transformation era in the past six months, which is characterized by Diversified Products, Quality Control, Sustainable Growth”. Despite impact of epidemic, and for the first time in several years we achieved positive net profit under Local GAAP. More importantly, we are making steady progress in institutional transformation with excellent results! This is the result of our collective effort, which deserves a round of applause for ourselves.

In the second half of this year, I hope we can continue our success through maintaining the momentum of turning losses into profits. While we need to strengthen the construction of “compliance culture”, we have to maintain a good general and branch linkage to support the transformation development. We have already climbed a small peak in the unusual first half of the year, let’s work together and continue to climb another peak!