安盛之星

AXA Stars

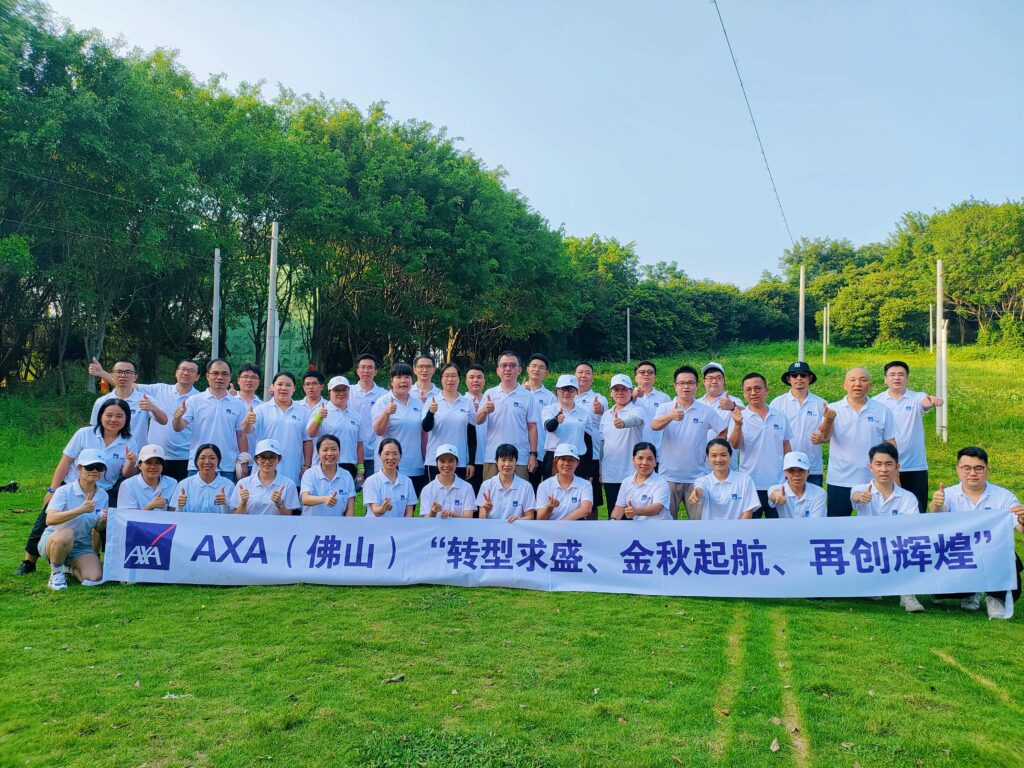

在安盛之星评选中,共有22位总部和机构同事摘取2022年度安盛之星,并分别获团结之星、勇敢之星、正直之星和转型之星。月刊将为这些同事专门开设“安盛之星的故事”专栏,帮助大家进一步了解安盛人践行安盛价值观的故事。

本月我们将为大家分享转型之星——济南中心支公司总经理助理葛明刚,勇敢之星——江苏分公司副总经理周荣斌,转型之星——直销在线中心培训发展部张弦,客户之星——天津分公司理赔客服部王玫的故事。

In the AXA Star contest , altogether 22 AXA colleagues from headquarters and branches are entitled to awards of AXA Stars in Transformation , Customer First , Integrity , Courage , and One AXA . This special column was set up for them so we can all know their stories in living the AXA values and making their contribution to the company’s growth.

This month we will introduce stories of our Transformation Star – GE Minggang, Courage Star – ZHOU Rongbin, Transformation Star – ZHANG Xian, Customer Star- WANG Mei.

转型之星——葛明刚

葛明刚自2011年加入安盛,目前在济南中心支公司担任总经理助理。他全力达成业务既定目标,引导全险种模块推进业务,致力于做出有利润的业务规模。2021年葛明刚大力推动齐鲁保项目,宣导产品的理念,进企业、进社区、进乡村等,积极参与宣讲活动。2022年他细化指标跟进、过程努力追进,负责的车险业务分销计划7044万,达成7660万,达成率109%;电销计划1802万,达成1742万,达成率97%。

Q1:请您分享一下获得安盛之星是什么样的感受?

首先,我非常开心与荣幸,荣获安盛之星既是对自己工作的肯定,也是对团队共同努力的回报。荣誉离不开公司领导给予的信任与支持,更离不开同事们的帮助与鼓励。其次,获得安盛之星后,更加意识到自己的责任和使命,更加注重团队合作,发挥模范带头作用,与同事共同成长、共同进步,更好地为公司和团队做出贡献。

Q2:平时生活中您有哪些保持自信、健康、快乐的习惯或者爱好?

平时生活中我一直有坚持早起的习惯。首先,早起有助于提高身体代谢,促进身体健康,有助于提高注意力和集中力,让人更加专注和清醒。其次,早起可以让我有足够的时间进行工作复盘和规划,利用早上的时间回顾近期工作的完成情况,总结经验和教训,思考对应的改进措施,同时规划下一步的目标及重点工作。

Q3:可以分享一下您最近在看的一本书、一部电影或一部剧吗?

最近观看了电影《三大队》。影片中刑警队长程兵,身陷囹圄,脱下警服后仍旧执于追凶破案。他对正义的执念,既让人心酸,更为之敬仰。十年如一日的追凶,并不是每一个人都能为之坚守。但正因为有着这样精神如炬,信念如磐的人,这个世界才总是充满光明,充满希望。现实工作当中,我们同样需要程兵这样的执着和坚守,目标清晰,不轻易动摇,激发内在动力,面对困难和挑战,坚持不懈,勇于尝试,不断寻求更好的方法和解决方案,带领团队朝着共同的目标前进。

Transformation Star – GE Minggang

Since joining AXA in 2011, Ge Minggang has been the General Manager’s Assistant at the Jinan Branch. He pours his heart into fulfilling performance targets, leading all insurance segments to improve their operations to expand the branch’s profits. In 2021, he made great efforts to drive forward the Jinan Insurance Project (Qilubao), giving speeches on the advanced philosophy of the products in companies, communities, and rural regions. In 2022, Ge Minggang refined the indicators and closely followed company progress to catch up on targets. The motor insurance distribution plan he was responsible for had a fulfillment rate of 109%, reaching 76.6 million sales compared with the 70.44 million target. The e-commerce distribution plan had a fulfillment rate of 97%, reaching 17.42 million sales compared with the 18.02 million target.

Q1: Would you share with us how it feels to receive the AXA Star Award?

I am extremely happy and honored to have received the AXA Star Award. Winning this award recognizes my individual work and our team’s collective effort. I owe this success to the trust and support of my superiors and the help and encouragement of my colleagues. After receiving the AXA Star Award, I am clearer about my responsibilities and mission; I value teamwork more. I will live up to my exemplary role and grow with my colleagues to better contribute to our company and the team.

Q2: What habit or hobby do you have to keep up your confidence, health, and happiness?

I always get up early; it is very good for your health. Getting up early helps improve metabolism, enhance physical health, and elevate focus. As a result, I am more focused and alert. Getting up early also gives me enough time to review my work and plan for the next step. I will look at what I have learned and think about how to make improvements; I also plan for the goals at the next stage and key areas that need attention.

Q3: Can you share with us a book, film, or TV show you read or watched recently?

I recently watched the movie Endless Journey. The film follows the protagonist, police captain Cheng Bing, who pursues criminals after being released from prison and is no longer a policeman. His obsession with justice is heartbreaking and admirable. Not everyone can commit their life to chasing criminals for decades without stopping. However, people like him who have such unwavering faith and strong spirit make this world full of light and hope. In our work, we also need to have the same determination as Cheng Bing, staying resolutely on our path. When we face challenges and obstacles, we have the courage to keep looking for better solutions to lead the team towards our common goals.

勇敢之星——周荣斌

周荣斌从事保险行业15年,现担任江苏分公司副总经理,主要负责非车险业务版块的推动。他梳理市场渠道,通过基础工作管理、队伍专业经营提升健康险业绩平台。他致力于推动三级机构进行业务转型,调整保费结构、人员结构,对三级机构总进行非车知识培训。同时他积极组建非车专属队伍,并拟定试行健康险渠道专属基本法,队伍人力从2人增至16人。2022年,周荣斌推动江苏机构非车业务转型,将机构非车业务占比提升至24%,健康险月均平台突破至200万,商业险月均平台突破150万,零售险月均达成350万。

Q1:请您分享一下获得安盛之星是什么样的感受?

很开心能够获评“勇敢之星”的荣誉称号,能够深刻感受到公司对我工作的肯定。感谢领导同事的包容及相互配合,才能够给到我机会和发挥空间。获得该荣誉,也深深地感受到了压力及鞭策。今后的工作中,需要更加严格要求自身,要把工作做得更好。对擅长的板块,要继续加强,对于不足的板块,要主动学习提升,维护好该荣誉称号。

Q2:平时生活中您有哪些保持自信、健康、快乐的习惯或者爱好?

除了工作外,平时生活中耗费时间最多的就是健身。好的身体状态,能让自己持续保持活力状态。当然,更是对自己、家庭的负责。

Q3:可以分享一下您最近在看的一本书、一部电影或一部剧吗?

最近没有深度的去读书或者看剧。但是我每年都能够反复观看的一部剧是《法医秦明》系列。喜欢看悬疑类的书及剧,是从父母那里养成的习惯;喜欢法医系列,则和自己的大学专业选读有关。这部小说/剧,呈现了一幅现代法医、刑侦、与人性的故事。每个系列都会由很多小故事组成,非常适合时间不太充裕的“我们”。

这部小说/剧,呈现了一幅现代法医、刑侦、与人性的故事。每个系列都会有很多小故事组成,非常适合时间不太充裕的“我们”。

秦明在小说中是主角——法医,也是叙述者。他以专业的眼光和冷静的笔触,剖析了一起起离奇的案件。通过对受害者身体的细致检查,他和他的团队运用法医技术,极致的分析及推理,将诸多线索抽丝剥茧,还原了每一个受害者背后的故事,告诉人们事件的真相,让施暴者得到法律的制裁。

这本书/剧,不能简单地用悬疑推理来定义,一系列离奇、复杂的案件背后隐藏着人性的多面性:贪婪、嫉妒、傲慢、暴怒等。在面对生与死、善与恶的选择时,有些人会因为一念之差而走上不同的道路:有对家庭的忠诚与背叛,有对子女的溺爱与控制,有对权力的渴望与恐惧.……这些复杂的情感与矛盾都在《法医秦明》中被展现。

所以,非常推荐大家去看看这个系列。

Courage Star – ZHOU Rongbin

Worked in the insurance industry for 15 years, Zhou Rongbin is the Deputy-Manager of the Jiangsu Branch, mainly responsible for the promotion of non-motor segments for the branch. He streamlines market channels, enhancing health insurance platform performance through groundwork management and specialized team operations. Organizing non-motor insurance knowledge training for tertiary institutions, Zhou Rongbin drives business transformations at the tertiary level by adjusting the premium pricing structure and personnel operation systems. He also actively encouraged the formation of specialized non-motor insurance teams and proposed running pilot guidelines designed exclusively for managing health insurance channels. His two-member team expanded to a large family of 16 members. In 2022, Zhou led the transformation of the non-motor segments in the Jiangsu branch, increasing the proportion of non-motor business performance to 24%, with a health insurance monthly platform exceeding 2 million, commercial insurance monthly platform over 1.5 million, and retail insurance monthly averaging 3.5 million.

Q1: Would you share with us how it feels to receive the AXA Star Award?

I am delighted to receive the AXA “Stars of Courage” Award, and I really feel that the company recognizes and appreciates my work. I am really grateful for the patience and teamwork of my colleagues and superiors. It is thanks to them that I had the opportunity to shine and room to grow. I also feel more pressure to do even better in the future. I am determined to be more disciplined and deliver better performance at work in the future. I will continue to improve on the segments I excel in and take the initiative to learn and improve on the segments where I fall short at the moment. I will live up to the title of AXA’s “Stars of Courage”.

Q2: What habit or hobby do you have to keep up your confidence, health, and happiness?

Aside from work, I spend most of my time exercising. A good physical condition keeps my energy up. Of course, maintaining health is also my duty to myself and my family.

Q3: Can you share with us a book, film, or TV show you read or watched recently?

I haven’t had time to really delve into a new book or a show lately. But a TV show that I can watch again and again every year is the Medical Examiner Dr. Qin series. I inherited the love for the mystery genre from my parents. I like the Medical Examiner series because of the courses I studied in university. For these reasons, I watch the Medical Examiner Dr. Qin series again every year.

The novel and the TV adaptation tell a story of modern medical examiners, criminal investigations, and human nature. It consists of many mini-stories, very suitable for us who only have a little free time.

Medical examiner Qin Ming is the narrator of the story. He dissects case after case of strange happenings with professionalism and calmness. By meticulously examining the victim’s body, he with his team used forensic science to analyze and deduct the story behind the case, unveiling the truth of the crime, and bringing the perpetrator to justice.

This book/drama can’t be defined as belonging to the mystery or detective genre. A series of bizarre and complex cases show us the many faces of humanity: greed, jealousy, pride, wrath. When faced with choices between life and death, good and evil, some people’s lives are changed forever with just one thought. In the stories, there is family loyalty and betrayal, adoration and control for one’s children, and desire and fear of power. These intricate emotions and dilemmas are all presented by Medical Examiner Dr. Qin.

I highly recommend you to have a look at the series.

转型之星——张弦

张弦自2009年2月加入安盛,目前在培训发展部负责培训管理工作。面临公司非车转型发展,张弦作为培训讲师一直积极思考和探索非车专业能力与技能的提升。她主动了解行业动态,提前熟知非车业务,潜心挖掘消费市场,积极探索非车销售思路,激发客户需求,帮助客户搭配非车产品,进而促进非车业绩增长。她致力于组织搭建直销在线中心非车培训体系,多维度开发课程15门,覆盖2961人次,覆盖率达99%。试点班整体非车业绩产能从训前保费1086842元提升至训后的1360973元,提升幅度高达25%。

Q1:请您分享一下获得安盛之星是什么样的感受?

能成为本届转型之星的获得者之一,我感到十分荣幸。人们常说一粒种子只有深植于一片沃土,才能拥有无限生机;我觉得一个人也是一样,只有置身于一个努力拼搏的氛围里才会有进步,才能蓬勃向上。我非常有幸能够来到这片沃土,在它的培养造就下,小小的我才得以成长。这份荣誉,也是对我们团队成员在转型道路上共同努力的肯定,我们将带着这份动力,继续密切配合公司领导的战略思路,保持开拓进取的心态,携手并进,不断前行。

Q2:平时生活中您有哪些保持自信、健康、快乐的习惯或者爱好?

善于发现生活中的点滴美好。生活是丰富多彩的,从不同的角度去观察生活,能够发现不同的美。有时是温暖的阳光、有时是翠绿的植物、有时是可爱的朋友、有时是意想不到的惊喜……这些美好的瞬间会让我感到无比的幸福和满足,从而对生活保持着热爱,因为热爱生活而被治愈,这本就是积极反馈的循环。

Q3:可以分享一下您最近在看的一本书、一部电影或一部剧吗?

《人生忽如寄》,莫负茶汤好天气。汪曾祺先生的文字,没有跌宕起伏的剧情,没有波谲云诡的情节,却如同一股温暖的涓涓细流,淌过心田。就像是一位慈祥的老人,向你娓娓道来他对生活的点滴感悟,文字间能感受到一种细腻温和的力量,同时不失真性情,清新可爱又治愈,日日有小暖,至味在人间。

Transformation Star – ZHANG Xian

Zhang Xian joined AXA in February 2009; she is working on training and management at the Department of Training and Development. Faced with the company’s transition to non-motor insurance, Zhang Xian has taken the time to consider and explore, as a training coach, improving her skill sets for non-motor segment operations. She took the initiative to learn about the latest news in the industry and studied ahead on non-motor insurance, spending her time digging potentials in the consumer market. She eagerly combed through sales strategies for the non-motor segments. She inspired consumers to realize their needs while helping them to organize a non-motor product portfolio, increasing sales numbers. Zhang Xian organized and constructed an on-the-job training system for non-motor operations at the direct sales online center, developing 15 multi-dimensional courses attended by 2,961 people, with a coverage rate of 99%. The non-motor business performance was consequently improved. Her pilot courses improved non-motor business performance by 25%, from the pre-training number of 1,086,842 RMB to the post-training number of 1,360,973 RMB.

Q1: Would you share with us how it feels to receive the AXA Star Award?

I am honored to be one of the people to receive the AXA Star in Transformation. People often say a seed needs fertile land to live up to all its thriving potential. I think the same is true for people: one only progress in an environment of striving for success. I am very fortunate to have found the “fertile land” for my growth; my achievements are thanks to its nurturing and encouragement. This honor is also a recognition of our team members’ collective efforts on the path of transformation. We will continue to closely align with the company’s strategic direction, maintain a pioneering spirit, and move forward together

Q2: What habit or hobby do you have to keep up your confidence, health, and happiness?

I have an eye for small happiness in life. Life is iridescent. You find different beauty in it from different angles. Beauty is the warm sunshine, the verdant plants, lovely friends, and unexpected surprises… these moments make me immensely satisfied and joyous. I am passionately in love with life, and in turn, my heartaches get healed because of that love. It’s a positive cycle.

Q3: Can you share with us a book, film, or TV show you read or watched recently?

Life is Short, by Wang Zengqi, encourages you not to let a day of perfect weather and a good cup of tea go to waste. Mr. Wang Zengqi doesn’t entice you with dramatic stories or cunning plots. His writing is a flowing stream that nourishes your heart as you read the book. It is like listening to a kind elder telling you about the things he learned in life. You can feel a gentle but firm strength between the lines; at the same time, he is also so very humorous about it! It is lovely and healing. Little sparkling moments in every day are the best things about life.

客户之星——王玫

王玫从事理赔工作多年,目前在天津分公司理赔客服部负责人伤法务管理工作。她长期积极践行“从赔付者到陪伴者”的服务理念,始于担当,诚于专业,带领医疗查勘团队积极转型,坚持从客户诉求出发,不断提高服务质量,以实际行动推动业务发展,有效促进公司业务持续发展。凭借专业知识和丰富经验,王玫连续多年被选拔为天津保险行业保险合同纠纷调解员,客户满意度高,在多家第三方机构、法院获得一致好评。

Q1:请您分享一下获得安盛之星是什么样的感受?

获得安盛之星的荣誉是我职业生涯中的一个重要里程碑。这不仅是对我个人工作的认可,更是团队协作的果实。这份荣誉不仅让我感到无比自豪,更激发了我不断提升的决心。我相信这个荣誉将为我的职业生涯注入新的动力,我将以此为契机,更加努力奋斗,为公司创造更多价值。这次荣誉是过去努力的回报,也是未来更高目标的起点。感谢同事们及公司的支持,期待在团队共同努力下,创造更多灿烂的业绩,为公司的未来贡献自己的一份力量。

Q2:平时生活中您有哪些保持自信、健康、快乐的习惯或者爱好?

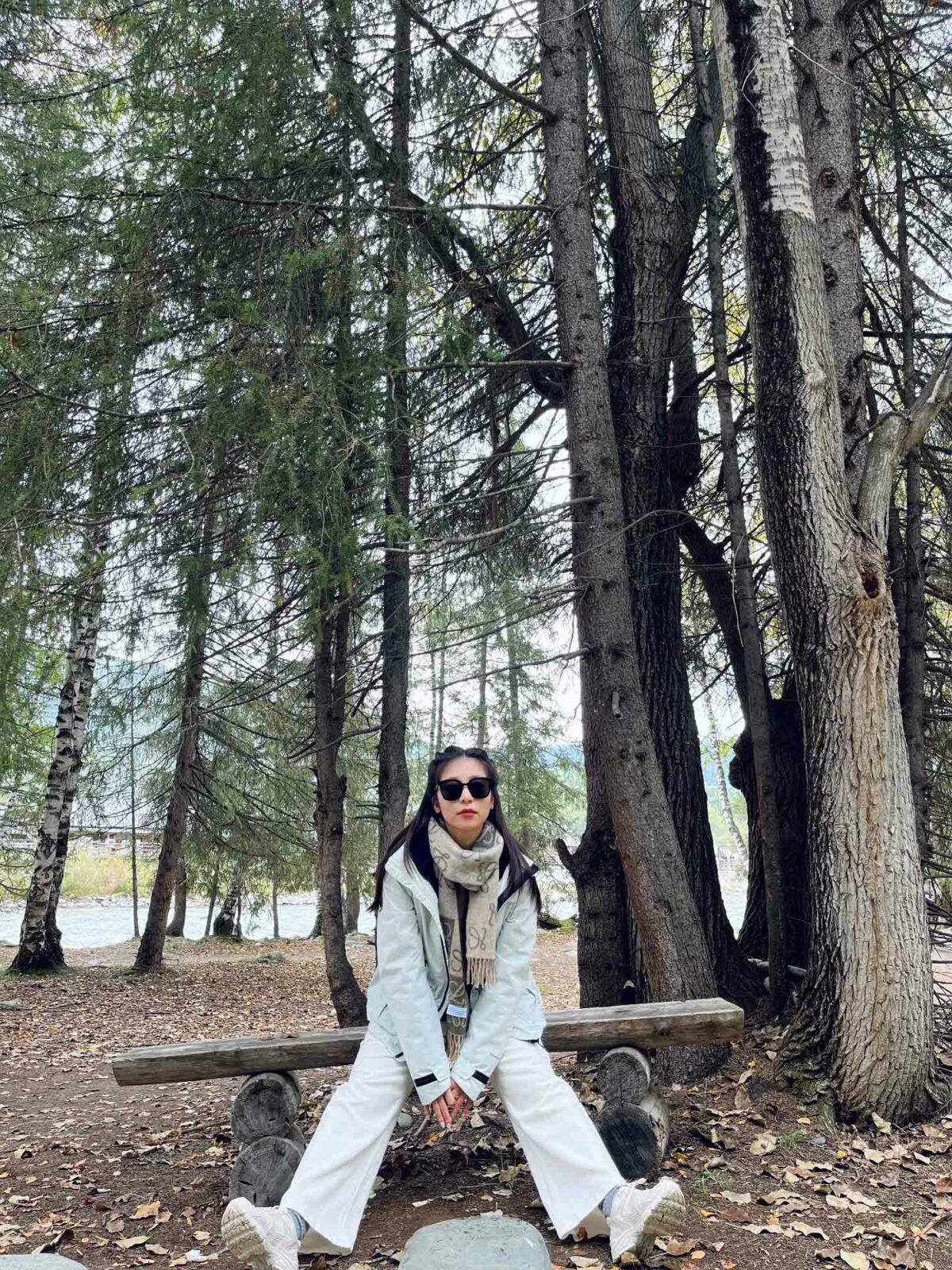

日常生活中,我极为注重通过健康饮食和旅行的方式来保持自信、健康及快乐。对于饮食,我钟情于控油少盐的健康饮食习惯,确保身体得到充分滋养。与此同时,旅行是我疏解繁忙生活压力的绝佳方式,让我有机会沉浸在不同的文化和风景中,从而为生活注入活力和新鲜感。这两个习惯不仅让我在享受美食的同时保持身体健康,也让我在探索世界的过程中找到内心的平衡,持续保持快乐年轻的心态。

Q3:可以分享一下您最近在看的一本书、一部电影或一部剧吗?

最近看了一部50年前的老电影《十二怒汉》,电影讲述了一个几乎就被定罪的弑父少年的案子,在庭审之后由十二个男人组成的陪审团讨论案情的故事。电影开始在一个纽约法院的门口,经过一个简短的庭辩总结之后,进入了陪审团讨论阶段。

电影里谈到了权力,亨利·方达所饰演的陪审员指责另一位陪审员说:我们有什么权力如此轻描淡写且毫不讨论地把另一个人的生命结束了呢。结束他人的性命并不是一件可以如此轻率的事,本来应该没有任何疑问的一场投票因为对生命应有的尊重而变得有点扑朔迷离了。大量的长镜头和语速极快的讨论,平和的反驳和合理的推断,这场长达九十分钟的辩论扣人心弦,节奏利落,结构紧凑,主题严肃,丝毫不因故事场景的局限性而显得沉闷。

以现在来说;两个月前的电影已经不算新片了。而这部穿越了50年时光的电影在如今看来依旧还能让人横生感触,这让我相信了经典。时光流逝,总有些东西会被遗忘;而有些东西则总会被人说起、想起并最终记住。

Customer Star- WANG Mei

Wang Mei has worked in the Claims Department for years. She is currently at the Claims Customer Service Department of the Tianjin Branch on legal management of personal injuries. She is a long-time practitioner of the service principle “from payer to partner”. With professionalism and a dutiful personality, she led the medical claims investigation team to make a proactive transformation and insist on improving service quality through the consumers’ perspectives and demands. Her concrete actions drove operation development, effectively facilitating the sustained development of the company’s business. With her professional knowledge and rich experience, Wang Mei has been selected as the mediator for insurance contract disputes in the Tianjin insurance industry for consecutive years, with a high degree of customer satisfaction rate, and has received unanimous praise from many third-party organizations and the court.

Q1: Would you share with us how it feels to receive the AXA Star Award?

Receiving the AXA Star Award marks a significant milestone in my career. It is not only a recognition of my own work but also the result of our outstanding teamwork. I am proud but also inspired to become better. I believe the award injects new motivations into my career. I will take this opportunity to work harder and create more value for the company. The award is the answer to my hard work of the past; it is also the beginning of achieving new heights in the future. I must thank my colleagues and the company for their support. Hopefully, we can deliver more excellent performance in the future, making contributions to the company’s future through our collective efforts.

Q2: What habit or hobby do you have to keep up your confidence, health, and happiness?

I think it is really important to travel and maintain a healthy diet to stay confident, healthy, and happy. I am particularly partial to less oil and less salt diet to make sure my body gets enough nourishment. Travel is a great way for me to relieve stress. It gives me the opportunity to immerse myself in different cultures and experience beautiful scenery, pumping new, refreshing energy into my life. These two habits help me enjoy great food and maintain physical health, keeping my internal balance as I explore the world and staying forever young and happy.

Q3: Can you share with us a book, film, or TV show you read or watched recently?

I recently watched Twelve Angry Men, an old movie from 50 years ago. The film tells the story of a boy in charge of patricide. Following the court proceedings, a jury of twelve men discuss his case. The first scene is at the front of a New York courthouse; after a brief summary of the case, the jury deliberation phase begins.

The film addresses the issue of power, with Henry Fonda’s character accusing another juror, What right do we have to kill someone so casually and without discussion? Ending another person’s life is not a matter to be taken lightly, and what should have been an unquestionable vote is now complicated by respect for life. With extensive long takes and rapid-paced discussions, calm rebuttals, and logical deductions, the ninety-minute debate is captivating, well-paced, tightly structured, and solemn. The story is never dull despite being set in a confined space.

Today, a movie from two months ago no longer counts as new. Yet, this film of 50 years ago still resonates today. I now believe that there are things such as timeless classics. Some may be forgotten with time. But some remains to be talked about, thought about, and remembered.