亲爱的安盛天平同事,

春回大地,万物复苏,安盛天平的伙伴们也早已投入到开门红的热潮之中。1月31日,2023年一季度全员大会在瑞明职场召开,我们共同回顾了在2022年取得的成绩,展望了2023年的发展前景,公司上下一心,更坚定地走在“高质量、多元化发展,并不断提升盈利能力”的正确战略道路上。

在全体同仁的辛勤努力下,2022年公司各项转型工作都取得了前所未有的成果和突破——整体保费增速达2%,机构非车保费占比达到22%,实现了“双轮驱动”的稳健增长模式;机构通过提升基础管理和渠道经营能力,不断向精细化管理迈进;车险业务保持韧性,商业险、零售险和健康险增速高于市场平均水平。与此同时,公司在提升车险定价、核保能力,布局新能源车,发力员福业务,完善非车系统和技术能力,强化消保工作,践行ESG等多方面都取得了不错的成绩。

随着疫情防控政策的放开,2023年既是机遇也是挑战,我们有理由对在中国市场的可持续增长有更大的期许和信心。而在更加激烈的竞争格局下,只有不断提升自身实力,才能决胜长期发展。

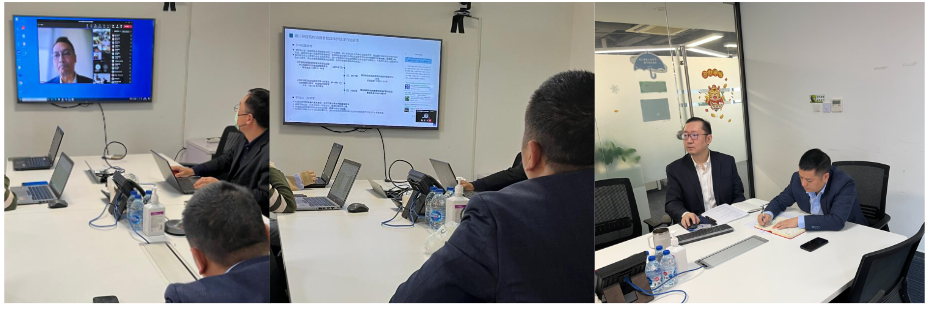

立春前后,我踏上了一系列巡访之旅,从天府之国的成都,到首都北京,再到齐鲁大地的济南,行程涵盖监管机构拜访、合作伙伴会谈、直销中心、电服中心及各地分支机构,在地管理团队和一线伙伴亲切交流座谈,期待大家以更旺盛的斗志,更发奋的姿态和更充沛的干劲,追求高质量的发展,实现盈利性的增长。

能者达人所不达,智者达人所未见。2023,使命必达!

Dear AXA colleagues,

With the return of spring, we at AXA Tianping have thrown ourselves into the year with renewed vitality and vigor. On January 31, our Q1 Townhall took place at the Ruiming office, where we took the opportunity to review our achievements in 2022 and look ahead to 2023. We unite as a company to achieve “high-quality, diversified development and continuous improvement of profitability”.

Thanks to the hard work of all colleagues, in 2022, the company has achieved unprecedented results and breakthroughs in various transformation tasks –

the growth rate of overall premiums reached 2% and the proportion of institutional non-motor insurance premiums reached 22%, demonstrating the steady growth of our “dual-engine” model. Additionally, we are constantly refining our management by improving channel operation capabilities; Our auto insurance business remains resilient, and the growth rates of commercial insurance, retail insurance and health insurance are higher than the market average. At the same time, the company has achieved good results in improving auto insurance pricing and underwriting capabilities, deploying new energy vehicles, developing employee welfare, improving non-vehicle systems and technical capabilities, strengthening consumer protection work, and practicing ESG.

With the liberalization of epidemic prevention and control policies, 2023 presents both opportunity and challenge. We have greater expectations and confidence in the sustainable growth in the Chinese market. Yet in a more competitive landscape, only by continuously improving our strengths can we win in the long run.

Earlier this spring, I embarked on a tour, from Chengdu, the land of abundance, to Beijing, the capital, and then to Jinan, the land of Qilu. The local management team and front-line partners had a cordial discussion. We look forward to our collective continued pursuit of high-quality development and achievements in profitable growth accompanied by a vigorous fighting spirit, can-do attitude and vivacious energy.

Let’s achieve all we can in 2023!

安盛天平首席执行官 左伟豪

CEO of AXA Tianping Kevin Chor