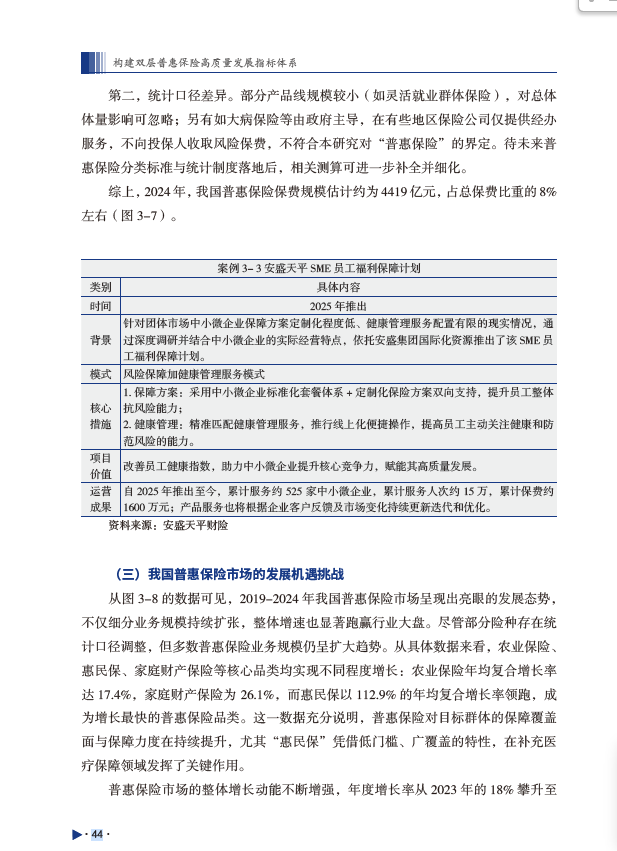

安盛天平中小微企业员福保障计划荣获“普惠金融产品创新奖”并入选《2025普惠保险白皮书》最佳实践案例

AXA Tianping SME Employee Benefits Protection Plan Awarded for its Inclusive Financial Product Innovation and Selected as Best Practice Case in the “2025 Inclusive Insurance White Paper”

“安盛天平中小微企业员福保障计划”在2025年10月举行的中国普惠金融国际论坛上荣获”普惠金融产品创新奖“,并入选《2025普惠保险白皮书》最佳时间案例。该白皮书在不久前结束的“第二届四明保险论坛暨中国保险学会2025年学术年会”上首次公开发布。

近年来,随着国家对普惠金融战略的持续推进,普惠团体保险作为普惠保险的重要组成部分,正逐步成为改善中小微企业用工保障的重要工具。2024年5月,国家金融监督管理总局发布《推进普惠保险高质量发展的指导意见》,进一步鼓励保司为小微企业、灵活就业人员等群体开发定制化保险产品,完善服务机制,为普惠保险发展明确了方向,也为团险产品的结构创新提供了制度基础。

为了精准满足中小微企业员工在医疗保障方面的真实需求,安盛天平围绕“多层级产品+一体化健康管理服务”的思路,推出了具备“低门槛、多责任、优服务、强连接“为特征的解决方案。整个员工福利产品体系设置多个保障档位,最低每人每年不到100元起,涵盖意外身故、意外门急诊、住院津贴等高频风险;高阶保障组合拓展至门诊医疗、住院补充、重大疾病确诊赔付等责任。传统保险多以事后理赔为核心,而该方案则通过与数字化健康管理平台的深度整合,将保障服务前移、下沉、常态化,为企业员工提供了全过程、全场景的健康陪伴与支持。让保险不再是“风险发生时才想起的补偿工具”,而是融入员工日常的“健康管家”。

该保障计划方案自2025年推出至今,我司已累计服务约525家中小微企业,累计服务人次约15万。后续我们将继续通过企业客户的反馈并结合市场变化不断更新迭代,助力中小微企业提升核心竞争力,赋能中小微企业高质量发展。

The “AXA Tianping SME Employee Benefits Protection Plan” was honored with the “Inclusive Financial Product Innovation Award” at the China Inclusive Finance International Forum held in October 2025 and was selected as a best practice case in the “2025 Inclusive Insurance White Paper.” This White Paper was first publicly released at the recently concluded “Second Siming Insurance Forum & 2025 Academic Annual Conference of the Insurance Society of China.”

In recent years, with the continuous national advancement of the inclusive finance strategy, inclusive group insurance, as a vital component of inclusive insurance, is gradually becoming an important tool for improving the employment protection of small and medium-sized enterprises (SMEs). In May 2024, the National Financial Regulatory Administration issued the “Guiding Opinions on Promoting the High-Quality Development of Inclusive Insurance,” further encouraging insurance companies to develop customized insurance products and improve service mechanisms for groups such as micro and small enterprises and flexible workers. This has clarified the direction for the development of inclusive insurance and provided an institutional foundation for structural innovation in group insurance products.

To precisely meet the genuine needs of SME employees in terms of medical protection, AXA Tianping launched a solution characterized by “low threshold, multiple coverages, superior service, and strong connectivity,” centered around the concept of “multi-tiered products + integrated health management services.” The entire employee benefits product system offers multiple coverage tiers, starting at less than 100 RMB per person per year, covering high-frequency risks such as accidental death, accidental outpatient/emergency care, and hospitalization allowances. Higher-tier coverage combinations extend to responsibilities including outpatient medical care, supplementary hospitalization benefits, and critical illness diagnosis payouts. While traditional insurance primarily focuses on post-event claims settlement, this plan, through deep integration with a digital health management platform, shifts and embeds protection services forward, downward, and routinely, providing employees with whole-process, all-scenario health companionship and support. This transforms insurance from being merely a “compensation tool remembered only when a risk occurs” into a “health steward” integrated into employees’ daily lives.

Since its launch in 2025, this protection plan has served approximately 525 SMEs, accumulating around 150,000 person-times of coverage. Moving forward, we will continue to iterate and update the plan based on feedback from corporate clients and market developments, supporting SMEs in enhancing their core competitiveness and empowering their high-quality development.