第八届新员工融入成长项目圆满举行

The 8th New Employee Orientation & Training Successfully Convened

为帮助新员工更快融入安盛大家庭,深入了解公司的文化与价值观,学习发展部特别筹划了一场为期一天的新员工融入成长项目。活动当天,部分管理层及部门长担任讲师,为新员工介绍部门职能、概述业务发展、分享工作经验,通过一系列精心设计的环节,新员工在深刻感受到安盛的使命与愿景的同时也加速了与跨部门同事的交流。

来自总公司各条线的20余名同事参与了本次培训,下面让我们一起感受一下精彩回顾:

执行副总裁兼首席渠道管理和销售官周连成为本次新员工培训做欢迎致辞,提出在行业历史性变革的时代,追求卓越、转型求盛是安盛天平的每一名员工都应该有的 “文化自信”。

学习和发展总监张洁以The history of AXA为脉络,为大家生动展示了“摘星之旅”、“沙漠开会”、“不死鸟图腾”等安盛标志性场景,感召新员工学习安盛在逆境中所秉持的坚韧品质与适应能力。

定价核保部助理总经理田帅作为安盛首届“勇敢之星”的代表,为新员工阐述了安盛价值观,以勇于表达为主题,鼓励大家在安盛这个包容和开放的平台上大胆表达。

总经理办公室主任兼首席转型官戴思远从宏观角度介绍了公司独特的战略定位及品牌价值:既兼具天平的“企业家精神”,又融合了安盛的全球视野、百年专业积淀及多元包容。此外,她还从微观角度分享了自己亲身参与的战略变革和转型项目,激励大家在安盛的大舞台中找到自己的价值和成就。

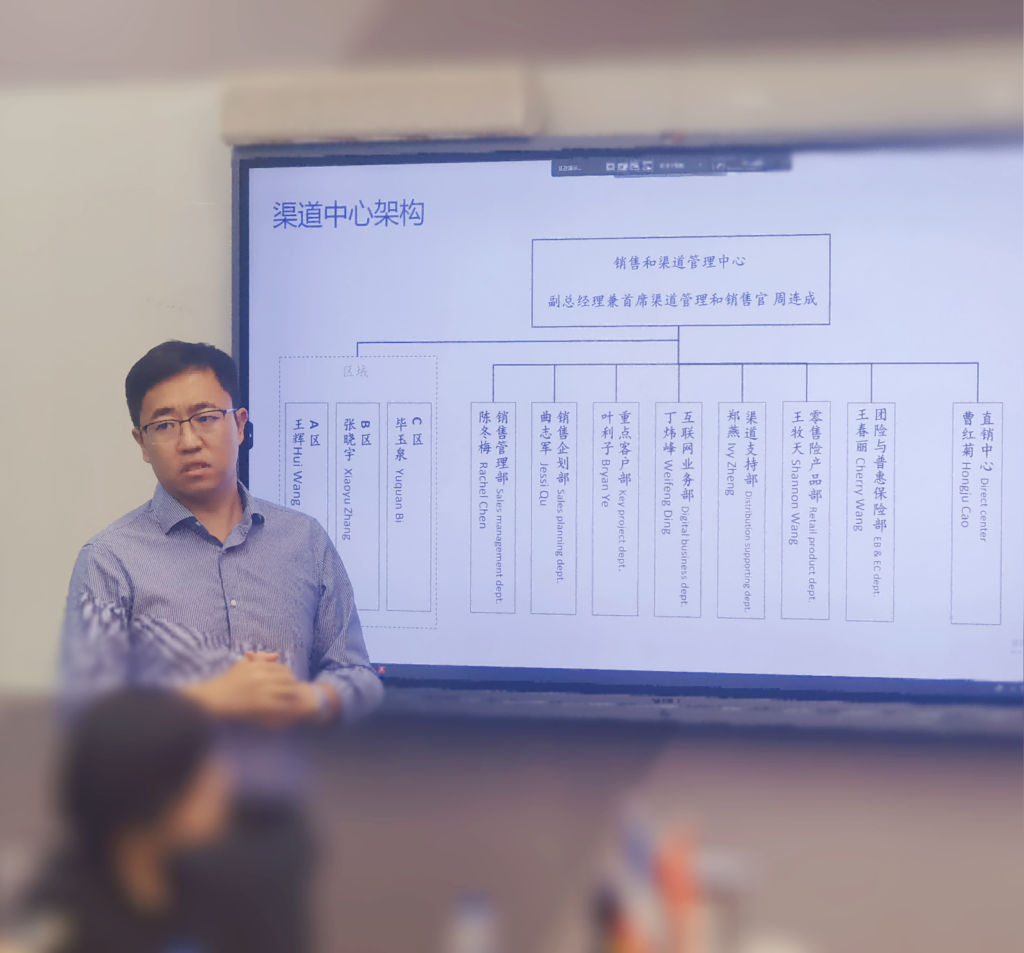

渠道支持部总监郑燕从销售渠道概览、渠道赋能和典型案例三个维度入手深入浅出地分享了公司经代渠道发展以及长期主义渠道经营策略的优势。

销售企划部总经理曲志军细致讲解了公司机构发展布局及经营策略,细,并表示2024年机构工作将围绕价值创造和合规经营持续开展。

首席健康险业务官丁侃介绍了基于DRG/DIP改革背景推出的安盛健康险的多样化解决方案。这些方案覆盖从大众化到高端市场,不仅简化赔付流程,更强化了整个健康管理服务周期的保障,体现了安盛在健康险领域的专业与创新。

团险和普惠保险部负责人王春丽详细介绍了团险和普惠保险部门的职能,包括团险的业务模式,以及普惠保险的业务客户群和发展方向。

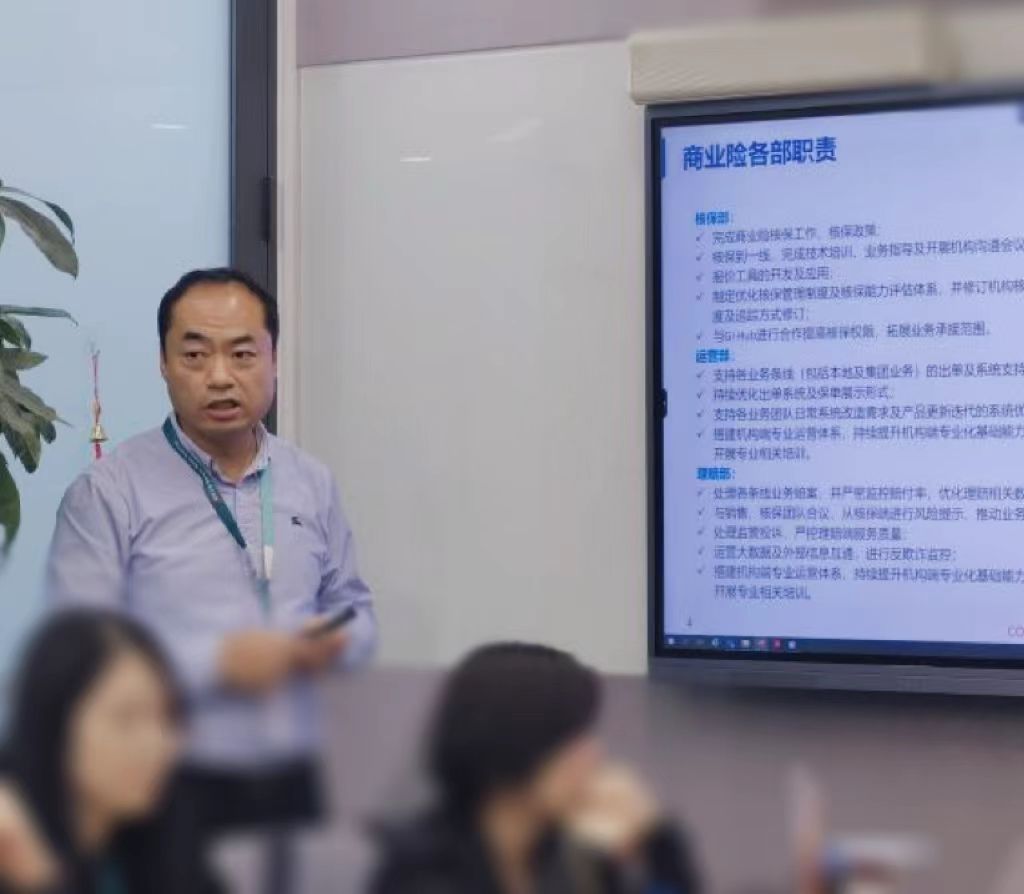

商业险事业部理赔部总经理刘海勇基于商业险各部门职责、主要险种、重点客户、各险种承保能力及偏好为大家分享了商业险的经营思路。

总经理助理兼首席理赔和客服官阳勇通过车险理赔案例,深入解析理赔过程中需要考虑的诸多因素,并介绍了部门架构,数据服务、数字化进展及投诉管理策略等内容。

定价核保部总经理张晓凤讲述了车险业务的三大显著特点,由此引申出车险定价和决策的复杂性,强调了精细化管理和跨部门合作的重要性。

法律和合规部负责人罗昉宜概述了部门职责,介绍了集团合规体系的要求,包括数据隐私、反贿赂和反腐败、反洗钱和制裁合规等,强调了合规在公司运营中的重要性。

首席财务官LAUR PIERRE DENIS详细介绍了大财务的三个关键团队的职能和工作内容,提出在2024年实现盈亏平衡,并通过关键战略举措为2025年和2026年的盈利增长奠定基础的三年战略规划,最后期望大家能为实现公司目标持续努力。

总经理助理兼首席风险官、董事会秘书裘海燕通过一个过河的比喻来阐释风险管理的重要性,强调风险管理的价值在于界定行动的边界,确保在安全范围内实现目标。他还介绍了公司成熟的风险管理体系,公司内部控制治理架构,风险管理团队的职责和对潜在风险事件的管理。

首席运营官兼首席数据官余健光展示了部门从IT到数据、项目、安全和运营等不同领域的发展。同时,也强调了公司IT环境的技术先进性,展示了公司的技术实力和24小时服务能力。

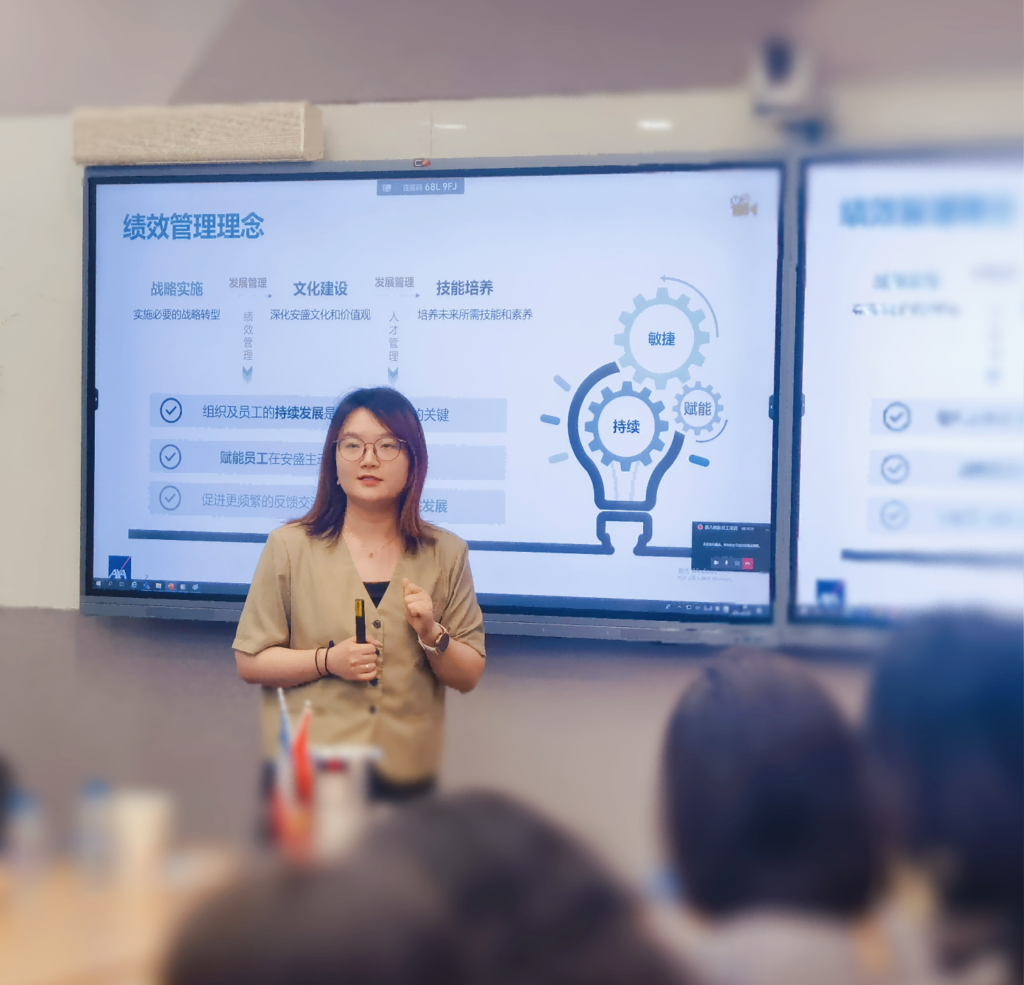

资深薪酬福利经理张如意和资深人力资源业务伙伴俞希分别介绍了薪酬福利政策和绩效管理理念,通过详尽的介绍,帮助员工更好地理解公司的薪酬福利和绩效管理体系,以及如何通过这些体系促进个人和组织的发展。

步入公司转型的新纪元,挑战和机遇并存。期望每一位优秀的新员工都能发挥出自己的价值,抓住机遇与公司共同成长,为公司注入新的活力和动力。

The 8th New Employee Orientation & Training was successfully convened to help new employees quickly integrate as well as to gain a deeper understanding of the company’s culture and its values. Organized by Learning and Development team, a one-day project was planned, engaging part of the company’s senior management team and department heads, who have lent their expertise and experiences regarding the functional roles of the departments, the overall business development to new employees. Through a series of well-designed activities, new employees deeply felt the mission and vision of AXA while accelerating interdepartmental communications with colleagues across different teams.

We would like to invite you to have a quick go-through of the training day:

Liancheng ZHOU, Executive Vice President and Chief Distribution & Sales Officer greeted new employees for joining AXA family, followed by emphasizing that every member should embrace the “cultural confidence” of AXA and to pursue excellence during the company’s transformation journey.

Jie ZHANG, Director of Learning and Development team, took The history of AXA as the context to vividly demonstrate some of the iconic scenes of AXA, namely “The Journey to the Stars”, “Meeting in the Desert”, and “The Phoenix Totem” to inspire new employees to learn the resilience and adaptability that AXA upholds in adversity.

Shuai TIAN, Assistant General Manager of Pricing and Underwriting team, embodying the spirit of AXA’s first “Star of COURAGE”, explained the values of AXA to the new employees and encouraged everyone to boldly express themselves and speak for themselves in AXA, where Inclusion and Openness are welcomed.

From a macro perspective, Siyuan DAI, Director of CEO Office & Chief Transformation Officer, introduced the company’s unique strategic positioning and brand value, which combines both the “entrepreneurial spirit” of Taiping Insurance and the group sophistication, diversity and inclusion of AXA’ Group. Furthermore, from a micro perspective, she shared her personal involvement in strategic changes and transformation projects, encouraging everyone to find their own value in this workplace.

Yan ZHENG,director of Distribution Support, provided an in-depth overview of the company’s broker distribution development and the advantages of its long-term strategy from three perspectives: sales channels, distribution empowerment, and typical case studies.

The General Manager of the Sales Planning team, Zhijun QU, thoroughly explained the company’s institutional development layout and business strategy, stating that in 2024, value creation and compliant operations will be prioritized and focused.

Fred DING, Chief Health Officer, introduced AXA’s diversified health insurance solutions launched against the backdrop of DRG/DIP reforms. These solutions cover a wide range from the mass market to the high-end segment, not only simplifying the claims process but also enhancing the security throughout the entire health management service cycle. This reflects AXA’s professionalism and innovation in the field of health insurance.

Cherry WANG, head of Group Insurance and Inclusive Insurance, introduced in detail the functions of the department, including the business model of group insurance, as well as the clientele and development direction of inclusive insurance.

Based on the responsibilities of various departments in commercial insurance, main insurance types, key customers, and the underwriting capacity and preferences of each insurance type, Haiyong LIU, general manager of the Claims Department of the Commercial Insurance Business Unit, shared the business operation ideas of commercial insurance with the audience.

As the Assistant General Manager and Chief Claims and Customer Service Officer, Yang Yong provided an in-depth analysis of various factors to be considered in the claims process through a case study of motor insurance claims. He also introduced the departmental structure, data services, digital progress, and complaint management strategies.

Xiaofeng Zhang, General Manager of Pricing and Underwriting Department, elaborated on the three prominent characteristics of motor insurance business, which led to the discussion of the complexity of its pricing and decision-making, emphasizing on the importance of refined management and cross-departmental collaboration.

Norman Luo, head of the Legal and Compliance Department, outlined the responsibilities of the department and introduced the requirements of the group’s compliance system, including data privacy, anti-bribery & corruption, anti-money laundering, and sanctions compliance. He emphasized on the importance of compliance in the company’s operations.

Chief Financial Officer, Pierre LAUR, detailed the functions of his three key teams in the finance department, and introduced a three-year strategic plan to achieve break-even in 2024 and lay the foundation for profitable growth in 2025 and 2026 through key strategic initiatives, expecting everyone to continue to work to achieve the company’s goals.

Richard QIU, Assistant General Manager, Chief Risk Officer and Secretary of the Board, used an analogy of crossing a river to illustrate the importance of risk management, emphasizing that the value of risk management lies in defining the boundaries of action and ensuring that goals are achieved within a safe range. He also introduced the company’s sophisticated risk management system, the company’s internal control and governance structure, the responsibilities of the risk management team, and the management of potential risk events.

The Chief Operation Officer and Chief Data Officer, Philip YU, showcased the department’s development in various areas, ranging from IT to data,to security, and operations. Meanwhile, he also emphasized the technological advancement of the company’s IT environment, demonstrating the company’s technological strength and its 24-hour service capability.

Senior Compensation and Benefits Manager Ruyi ZHANG and Senior Human Resources Business Partner Xi YU separately introduced the compensation and benefits policies as well as the performance management policies. Through detailed introductions, they helped employees gain a better understanding of the company’s compensation, benefits, and performance management systems, as well as how these systems can promote personal and organizational development.

As we step into the new era of the company’s transformation journey, challenges and opportunities coexist. Every new employee is expected to offer vitality and energy, seizing the opportunities to progress with the company.