安盛集团新兴客群团队来访 助力推动普惠保险深入发展

AXA Emerging Customers team visited China to help promote the in-depth development of inclusive insurance

7月18日,安盛集团新兴客群全球CEO花沐晨(Garance Wattez-Richard)携同安盛集团新兴客群数字健康、客户洞察及培训负责人Michal MATUL、安盛集团新兴客群产品和技术负责人Nadia BOUGHABA一行到访中国,在安盛天平健康险事业部总经理王春丽、安盛天平健康险事业部新兴客群经理肖舒婷等人的陪同下,先后拜访了浙江农商联合银行、微医集团,以及青岛当地的相关政府机构。在介绍安盛集团普惠保险业务的发展历程,以及安盛天平积极参与惠民保等普惠保险业务的实践经验的同时,与各方深入探讨了未来携手合作的美好前景,对于共同深入推动普惠金融落地,服务中低收入群体及中小微企业寻求共识。

第一站:拜访浙江农商 筹划普惠保险合作落地

7月18日上午,花沐晨一行在中国人民大学中国普惠金融研究院(CAFI)秘书长陈红珊、安盛天平浙江分公司总经理何中晓的陪同下,走访了浙江农商联合银行。该行党委副书记、拟任行长陈博恺为首的管理层进行了热情接待,并向安盛团队介绍了浙江农商在普惠金融及保险方面的业务信息,以及在保险合作方面的现状,并提出了对合作保司的期待。

浙江农商联合银行以“姓农、姓小、姓土”为核心定位,资本金实力雄厚,业务量全省排名前五。作为“做业务最实、与民企最亲、离百姓最近”的银行,该行肩负地方金融排头兵、农村金融主力军、普惠金融引领者的使命担当,在推动普惠金融发展方面已有相应举措,包括支持系统对接,已制定准入标准并拟定准入保司清单,其麾下各支行可与其中3家保司展开合作。

在听取了浙江农商的介绍之后,花沐晨介绍了安盛集团普惠保险在国内外市场的发展历程与策略经验,以及携手中国普惠金融研究院共同实施的《财务日记》项目详情。双方就未来在普惠保险领域的深入合作进行了充分友好的交流,并对未来的合作充满期待。

第二站:走进微医,推动普惠保险数字化创新

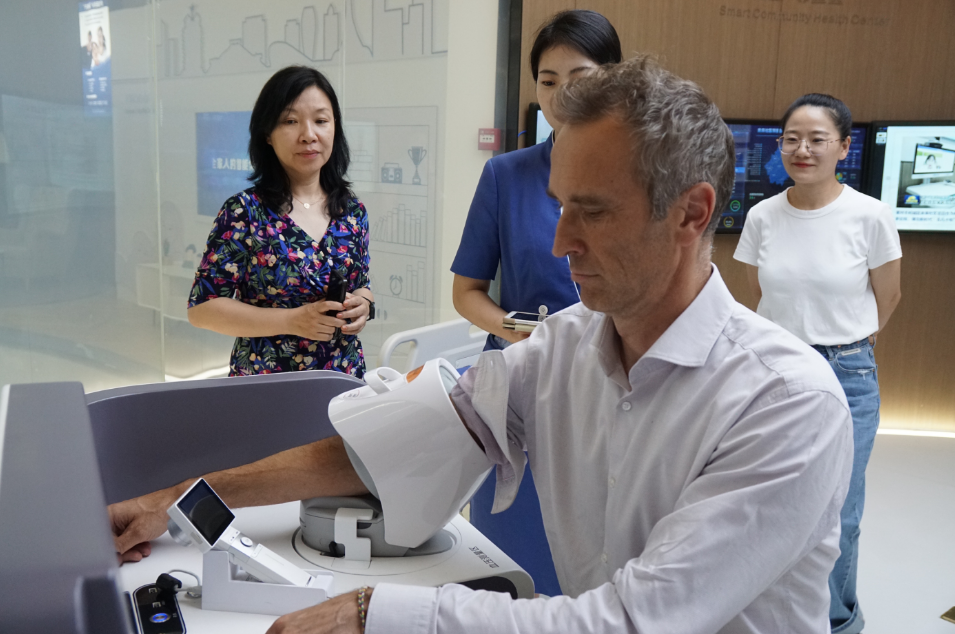

7月18日下午, 花沐晨一行拜访了国际领先的数字健康平台——微医集团,该集团以“您的健康,我们的责任”为使命,向政府、医院、个人及家庭、企业机构等多方提供专业化、个性化、多元化的医疗健康解决方案。双方在贯彻健康中国2030规划纲要,助力建设健康城市、健康乡村、健康个人以及健康企业的过程中有很多合作的契机。

微医企业会员销售总监施胜辉介绍了该集团的发展历程。这家数字健康领域的独角兽平台创建于2010年,拥有全国唯一的第三方医药交易平台牌照,中国第一家互联网医院——乌镇互联网医院,目前已拥有34家互联网医院,注册用户约2.6亿名,注册医生约30万名,三甲医院覆盖了全国95%以上的资源,在数字医疗领域的市场占有率超过15%。在之后参观微医展厅的过程中,更加深入地探讨了“互联网+医疗健康”未来的发展前景,并就后续的合作可能进行了深入地沟通。

第三站:论道青岛,共绘普惠保险落地蓝图

7月20日,在安盛天平青岛分公司总经理田雷的陪同下,安盛集团新兴客群团队拜访了青岛市民政局和医保局,在向相关政府部门领导介绍了安盛集团普惠保险经验及优势,以及安盛天平的发展状况和在国内推行普惠保险的实践等信息。双方共同展望了后续合作的意向,为普惠保险的落地奠定坚实的基础。

在青岛行程期间,安盛天平健康险部门EC团队还组织了普惠保险工作坊,山东、青岛、北京、江苏、安徽、云南、广西、天津和河南等多家分公司同事参加了此次培训。集团代表介绍了新兴客群及健康险业务在全球各市场的发展情况,健康险部门负责人王春丽总介绍了安盛天平在普惠保险业务方面取得的进展及目标运营模式,同时分公司同事也先后分享了惠民保、政府类、特定客群等项目的落地经验。

在讨论环节,大家就普惠保险业务机会、优质业务标准、项目成功关键因素等话题展开热烈讨论,并就各家分公司如何因地制宜地拓展相关业务分享了心得体会。在探讨当前业务机会的基础上,为制定后续行动规划做好了准备。

媒体专访

安盛集团新兴客群全球CEO花沐晨(Garance Wattez-Richard)在此次来访行程中,接受了多家主流权威媒体的采访,分享安盛集团普惠保险发展策略与经验的同时,有效传递了安盛天平响应国家普惠金融战略,积极参与多地惠民保项目,履行企业社会责任的信息,为公司的可持续发展营造了良好的舆论氛围。相关报道已陆续刊出,请大家通过下方链接了解更多详情:

- 证券时报:惠民保市场地位已建立数据周期还需要更完整

- 中国新闻社:对话安盛集团花沐晨:惠民保对商业保险的“挤出效应”将逐步消解

- 每日经济新闻:安盛集团新兴客群全球CEO:参与惠民保积累的经验和数据,对于将来做定制化保险非常有价值

- 澎湃新闻:安盛集团新兴客群全球CEO:惠民保长期可持续,但需更完整的数据周期

Garance Wattez-Richard, CEO of AXA Emerging Customers, together with Michal Matul, Head of Digital Health, Consumer Insights and Training at AXA Emerging Customers, and Nadia Boughaba, Head of Product and Technology at AXA Emerging Customers, visited China on July 18. Accompanied by Chunli Wang, General Manager, AXA Tianping health insurance business, and Shuting Xiao, New Clients Manager, AXA Tianping Health Insurance Division, the team visited Zhejiang Rural Commercial United Bank, WeDoctor Holdings, and other government organizations in Qingdao. Our colleagues introduced the history of AXA Group’s inclusive insurance business and AXA Tianping’s practical experience with inclusive insurance business such as Huiminbao. The team also discussed the prospects of future cooperation and sought alignment on jointly promoting inclusive finance which serves both middle- and low-income groups as well as small, medium-sized, and micro enterprises.

The First Stop: Visiting Zhejiang Rural Commercial United Bank in preparation for inclusive insurance cooperation.

In the morning, Garance and the team paid a visit to Zhejiang Rural Commercial United Bank. The visit was accompanied by the Secretary General of China Academy for Inclusive Finance (CAFI) of Renmin University of China, and Mr. Zhongxiao He, General Manager of AXA Tianping Zhejiang Branch. Officials of the bank, headed by Bokai Chen, Deputy Secretary of the Party Committee and the proposed president of the bank, gave a warm welcome and briefed the AXA team on the bank’s business in inclusive finance and insurance. They also introduced the current bancassurance developments and wish for future collaboration.

Zhejiang Rural Commercial United Bank’s business is anchored in “agriculture, small business, and land”. The bank is well-funded and ranks among the top five in the province. As a bank that “handles the most practical business and stands the closest to private enterprises and people”, the bank plays a major role in the local banking and finance function and the rural finance system as a pioneer of inclusive finance. The bank has put in place several measures to promote inclusive finance, including providing cross-system support and pulling together a list of insurers for the programme. Different branches can then get to collaborate with three insurance companies from the list.

After the bank’s introduction, Garance also talked about the development and strategy of AXA inclusive insurance in both domestic and international markets. He also provided details on the Financial Diary project jointly developed with the China Institute for Inclusive Finance (CIIF). Both parties exchanged valuable insights regarding the future of inclusive insurance.

The Second Stop: Visiting WeDoctor to promote the digital innovation of inclusive insurance

In the afternoon of 18 July, Garance and the team visited WeDoctor, a leading international digital health platform, which takes “Your Health, Our Responsibility” as its mission. It provides professional, personalized and diversified medical and health solutions to governments, hospitals, families and individuals. In implementing the Healthy China 2030 and building healthy cities, healthy villages, healthy individuals and healthy enterprises, there are many opportunities for cooperation.

Shenghui Shi, Director of Corporate Membership Sales of WeDoctor, introduced the group’s development history. Founded in 2010, this unicorn company in digital health has the country’s exclusive third-party pharmaceutical trading platform license, China’s first Internet hospital, Wuzhen Internet Hospital, and 34 Internet hospitals, with about 260 million registered users and about 300,000 registered doctors. WeDoctor has access to over 95% of resources in China’s primary hospitals. The company takes up more than 15% market share in digital healthcare. During the visit to the showroom of WeDoctor, both sides discussed the development prospect of “Internet + Healthcare” as well as subsequent cooperation in depth.

The Third Stop: Visiting P&C Insurance in Qingdao to set ambitious blueprint

On July 20, the AXA Emerging Clients team, led by Lei Tian, General Manager of Qingdao branch, visited the Civil Affairs Bureau and Health Care Security Administration of Qingdao. During the visit, the team presented AXA’s expertise and capabilities in P&C insurance to officials and discussed AXA Tianping’s development and its successful practice of P&C insurance in China. The meeting laid the groundwork for future cooperation and fostered a strong partnership for the advancement of P&C insurance implementations.

During the visit, the AXA Emerging Clients team organized workshops on P&C insurance, bringing together colleagues from various branches across Shandong, Qingdao, Beijing, Jiangsu, Anhui, Yunnan, Guangxi, Tianjin, and Henan. The Group’s representatives presented insights about newly emerging clients and the global health insurance market. Chunli Wang, the head of the health insurance team, showcased AXA Tianping’s progress in P&C insurance and the tailored operational approach. Colleagues from different branches also shared their experiences in implementing projects for Huiminbao, as well as governmental bodies and other specific client segments.

During the panel, a lively discussion unfolded on topics such as P&C insurance business opportunities, business standards, and key factors for success. Everyone shared insights on how different branches can develop business strategies tailored to local conditions. Beyond exploring current opportunities, the panel also included follow-up actions to advance the program.

Media Interviews

During the visit, Garance Wattez-Richard, CEO of AXA Emerging Clients, engaged in interviews with influential media outlets. He shared AXA’s strategies and experience in developing P&C insurance, highlighting AXA Tianping’s active participation in the Huiminbao program across China in alignment with the country’s inclusive finance strategy. He emphasized the company’s strong sense of corporate social responsibility which has contributed to the company’s sustainable growth. For media reporting, please click the links below to read full articles.

- Securities Times: Huiminbao’s market position has been established; data cycle needs to be more complete

- China News Agency: Dialogue with Garance Wattez-Richard of AXA Group: Huiminbao’s “crowding out effect” on commercial insurance will gradually dissipate

- National Business Daily: Global CEO of AXA Emerging Customer: Experience and data of Huiminbao very valuable for future customized insurance

- The Paper:Global CEO of Ansheng Group’s Emerging Customer Group: Huimin Baolong term sustainability, but requires a more complete data cycle