315消费者权益保护周活动

Consumer Rights Week Campaign

围绕今年消费者权益保护周的主题——是“共促消费公平,共享数字金融”,安盛天平由客户服务团队统筹,在全司开展了“3·15”消费者权益保护教育宣传周活动。

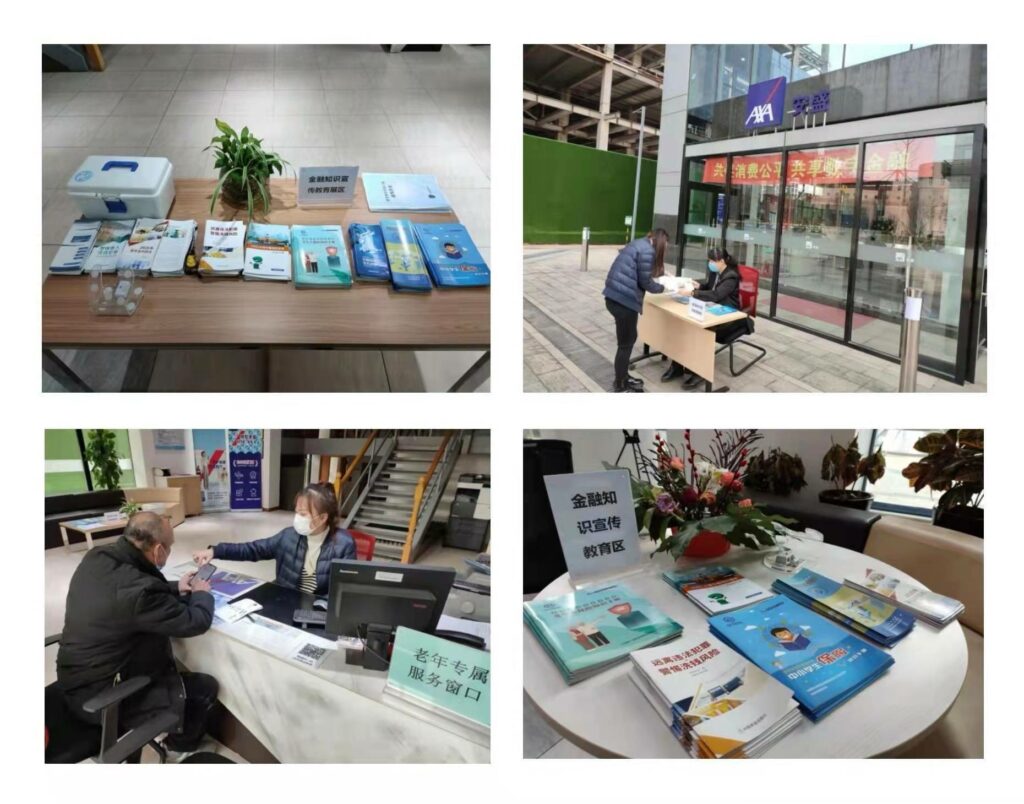

期间,总分公司结合疫情防控的要求,通过多种线上渠道进行大力宣传,积极落实监管要求。微信公众号文章、信息长图、动画等生动有趣的数字化载体,有效扩大了宣传覆盖范围,实现了引导消费者选择合适的保险产品,传播金融消费风险防范意识的初衷。安盛天平的各线下网点也通过张贴宣传海报、发放宣传手册、电子屏轮播海报与视频等方式,实现线上线下互动,推动金融知识传播落地,提升消费者识别和防范非法金融活动的意识和能力,提高了社会公众的金融素养。

比如大连分公司就在第一时间成立活动小组,对各宣传网点工作进行重点布置,并于3月11日举行了特别晨会,具体宣导活动周方案。要求各宣传网点按照监管、协会及总公司对活动周的相关要求,结合分公司活动方案,不打折扣地落实具体宣传活动,尤其对上门服务的老年客户及特殊群体客户予以格外关注,指派客服专员一对一服务,对线上化操作进行全流程跟进指导。

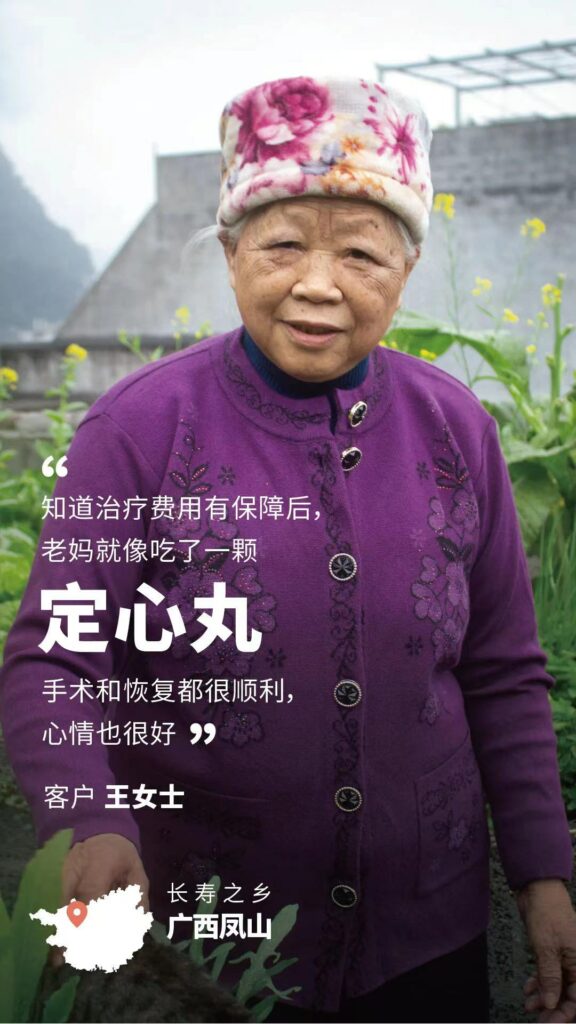

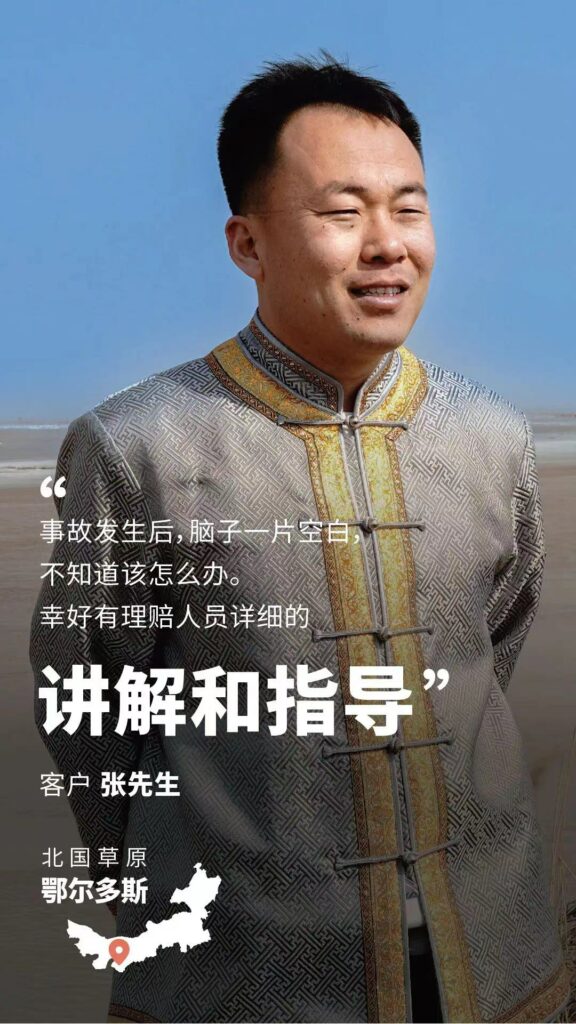

在为消费者提供优质产品和保障服务的同时,我们还会持续通过发布消费者洞察、进行消费者宣传教育、优化消费者服务、助力老弱群体跨越数字鸿沟,提升赔付流程效率等实际行动为客户带来安心与暖意。

This year’s 3·15 Consumer Rights Week centers around the theme of “Promoting Fair Consumption and Digital Finance”. Led by the Customer Service team, we have launched the 315 campaigns across headquarters and branches from March14 to March20 on various online and offline channels.

Our branches promoted lively educational content through digital mediums such as Weibo posts, infographics and animations to expand coverage of the campaign, with the aim to guide consumers in choosing suitable insurance products, and to raise awareness of financial risk prevention. The branches have also posted posters, distributed brochures, and played event posters and videos on in-store screens to disseminate financial knowledge and to enhance the financial literacy of the general public, by improving public awareness and ability to identify and prevent involvement with illegal financial products and activities.

Taking Dalian branch as an example. The branch created a campaign working group in the first place and deployed execution plans for its sub-branch network. They held a special morning meeting on March 11th to make sure our staff are fully aware of regulatory requirements. Our Dalian colleagues were particularly attentive to the needs of the elderly and vulnerable groups, providing them one-on-one service and close online guidance.

While providing consumers with good products and service guarantees, we continuously enhance financial self-protection and risk prevention capabilities of consumers and will continue to do so through publishing consumer insights, educating consumers, optimizing consumer services, helping the elderly and vulnerable groups to cross the digital divide and improving the efficiency of the compensation process, bringing peace-of-mind and warmth to our customers.