凝心聚力 转型求盛——站在安盛天平3.0时代的起点

3.0 Era of AXA Tianping: United, for a successful transformation

1月20日,安盛天平2021年业务总结暨2022年业务宣导会在上海举行,在共同回顾2021年收获与成绩的基础上,共同展望了2022年的奋斗目标和发展方向,正式确定公司发展进入新纪元——以“多元产品,品质把控,持续发展”为特征的3.0时代。负责渠道和意健险中心的执行副总裁周连成从机构管理、渠道创新的角度详细阐述了对3.0时代公司发展策略和方向的理解。

解读3.0时代

3.0时代的发展理念和1.0、2.0是一致的,尤其在品质经营、可持续发展方面,这是安盛天平所一直倡导的经营理念。从1.0时代以规模导向、单一车险业务线为主,向价值导向、业务多元模式加速转型,市场考验了我们的渠道、承保和理赔等综合能力;2.0时代车险进入转型深水区,安盛天平也加入到以健康险为代表的非车险业务转型的行列之中,经过一年努力,在渠道合作、团队培养等方面取得了一些进步;如今我们已经站在了以“多元产品,品质把控,持续发展”为主要特征的3.0时代的起点,这个时代将更加强调全面的销售能力,这意味着将更加强调全面的销售能力,要求我们以品质为导向,做有价值的业务。

3.0时代是企业使命、品牌理念和发展战略三方面的融合更新,我们回归财险公司的本质,进一步丰富和完善产品线,兼顾车险与非车险的多元产品布局,通过对现有产品迭代开发来寻找新的业务支点,如团险、商业险等,实行传统经代、分销渠道与数字化、电销渠道融合并行的多元渠道发展策略;公司将持续优化基础建设与后端支持,通过培训、提升、督导,做好品质管控,在经营中实现产品和利润的精细化管理,强调精细化、制度化、规范化和流程化的经营管理,夯实分支机构与渠道的经营和销售能力;同时以实现长期经营和可持续发展为目标,持续推进队伍建设、渠道建设、制度建设和合规建设,注重发展中的风险管控和合规经营。

面对3.0时代的机遇与挑战,公司已经明确提出了更加全面发展的战略方针,我们有信心引导业务更好、更优地发展,期待2022年能够打造全新局面,战略升级再创辉煌。

温故2021

我们都是用自己习惯的尺度、体系来理解我们并不熟悉的新鲜事物、现象。因此在展望2022之前,很有必要回顾一下我们在2021所取得的成绩。

2021年是经代渠道合作元年,在“平台经营和推动”的主旋律下,分支机构初步掌握了与经代渠道合作的知识与能力。以山东分公司为代表的一些分支机构经营能力显著提升,并且在制度完善方面表现突出,呈现出组织推动能力强,经营效率高的特色。

健康险保费平台稳步提升,年末较年初提升3倍,在四季度更突破8000万元关口,河北、山东、河南、北京、上海、江苏、浙江等7家机构的年化保费突破1000万,机构保费来源主要为传统经代,占比约77.8%。从单一车险到多元化产品销售的过程,同样也是从刚需型产品的销售到更讲究技能化的销售能力提升的过程,充分体现了公司对团队的要求——“思想到位,执行到位,结果到位”。

知新2022

时间进入2022,保险行业在各项新规落地的背景下,有望实现良性的可持续发展。尤其对于财产险公司来说,车险综改政策出台一年之后,行业增速有望得到修正并趋于理性化发展,整体经营成本的下降也有利于财产险公司的长期可持续经营。新能源车条款的落地也为行业发展带来了全新机遇,有望打破新能源车险普遍亏损的现状,鼓励更多企业探索新的合作模式。去年9月,全国新能源车的新车渗透率已经达到20%,这是一个我们必须进入的市场,总公司已经组织成立专门的工作小组对新能源车的业务发展进行专项的研究规划。

健康险领域整体可能延续2021年的发展态势,并且将以开拓团险市场作为突破点,并搭建一系列销售、核保、理赔、系统服务等配套支持系统,强化前线的专业技能,对客户业务有深刻洞察与理解。团险产品不是简单的销售一份保险产品,其本质是提供一个解决方案,要能够发现客户经营中所面临的问题,并有能力协助解决。

尽管疫情对宏观经济的影响仍将在一定程度上延续,老百姓的支付能力和意愿也都受到不同程度的影响,并直接影响到长期重疾险业务的拓展。但普惠型补充商业医疗险(惠民保)则有很大机会维持强劲增长势头。我们要牢牢把握城市惠民保和中高端医疗险驱动的市场机遇,继续深化经代渠道经营,把握客户购买行为发展趋势,积极探索新的数字化营销模式。

转型求盛,One AXA

展望2022年,任重道远,我们有信心携手前行,实现转型目标。这份信心来自安盛强大的品牌力加持,来自大中华区更加充分的资源共享,来自安盛天平战略的坚定,来自各位同仁团结一致、方向一致,相信我们合力一定能实现既定目标,在新的赛道上迎接新的胜利。

没有热忱,便无进步。在此与大家分享我们在今年开门红宣导会议上喊出的口号——“转型求盛,ONE AXA!”希望团队在新的一年,以踏实肯干的精神,迎难而上的勇气,转型必胜的信心,全力以赴、使命必达,打好安盛天平3.0时代的开局之战。

走近渠道和意健险中心

(供中国大陆区以外同事观看,For AXA colleagues outside mainland China)

On 20 January, the 2021 Branch Performance and 2022 Business Boosting Conference took place in Shanghai, announcing the 3.0 Era of AXA Tianping with a focus on “Diversified products, Quality driven, Sustainable growth” to continue strengthening motor, accelerating Health, and developing commercial. Liancheng ZHOU, Executive Vice President of AXA Tianping has shared his reflection and insights on distribution management and distribution innovation per his understanding of 3.0 Era of AXA Tianping.

Deep Dive into 3.0 Era of AXA Tianping

Quality-driven and Sustainable growth has always been at the core of AXA Tianping’s operation and is what makes the 2.0 strategy and 3.0 strategy consistent. The transformation journey, from a volume-driven, mono-liner business model to a value-driven, multi-liner business model has a test to our overall distribution, underwriting and claims capabilities. Since the 2.0 Era, AXA Tianping has joined other insurers to pivot business from motor to health. Some major progress has been witnessed in distribution cooperation and talents training but need to be further reflected on the branch level. The new era requests that we reinforce our sales capabilities to provide value-oriented services to customers, which explains the three – tiered focus of 3.0 Era: “Diversified products, Quality driven, Sustainable growth”.

The concept of “3.0 Era” is the creation of our integrated corporate purpose, brand promise and development strategy. We expand and diversity our product portfolio, covering motor and non-motor products to seek new business opportunities by upgrading our existing pipelines such as EB and Commercial; we strategize to make our distribution channels hybrid, incorporating traditional agents, distribution, digital and call center; we continue to optimize our infrastructure and backend support for a better quality control and a more refined management process, through a series of trainings, improvement plans and monitoring; we strengthen our sales and distributions’ capabilities for a long-term growth and sustainable development; we keep investing in team building, distribution cooperation, and mechanism set-up, focusing on risk control and compliance.

Of course, there will be opportunities and challenges, in face of the 3.0 era, but we have clearly put forward a more comprehensive development strategy that guides our business optimally. We are confident to change the track for greater glories in 2022.

Reviewing 2021

Let us now review our milestones of 2021 so that we have a better outlook on 2022 strategy.

We have initiated our distribution cooperation in the year of 2021 and has empowered branches in this field. Shandong branch for instance has significantly increased their operation and has optimized their organization as a result.

In addition, the health insurance premium platform has been steadily improved, with a three-fold increase at the end of the year compared with the beginning of the year, exceeding the 80-million-yuan mark in the fourth quarter. The annualized premiums of seven institutions including Hebei, Shandong, Henan, Beijing, Shanghai, Jiangsu, and Zhejiang exceeded 10 million. The source of premiums is mainly the traditional agents, accounting for about 77.8%. The pivot, from mono-liner sales to multi-liner sales, reflects precisely the change from sales driven by rigid demand to sales driven by growing unmet needs, which explains the core values that we request our team to possess, which are: strategy, execution, and delivery.

Expecting 2022

Moving to 2022, the industry is expected to enter a better chapter under a new regulatory landscape, especially for P&C insurers who might benefit from a more rational industry growth rate and a decline of operational costs as a result of the motor deregulation, initiated a year ago. The new energy vehicle projects will bring new opportunities that encourage the industry players to seek new patterns of cooperation, breaking the status quo of the general loss of new energy vehicle insurance. Since September 2021, the penetration rate of new energy vehicles in the country reached 20%. This is a market we must enter. A dedicated workforce has been set up to conduct research and planning on the business development of new energy vehicles.

We will continue to expand health and will officially open up the EB market as a breakthrough point, developing employee welfare business while building a series of supporting systems such as sales, underwriting, claims, system services, etc., and to strengthen the frontline with professional skills, deep insight and understanding of customers. The employee welfare product is not a simple insurance product, but rather, a solution to customers’ pain points.

Under the pandemic situation, customers’ ability to purchase and consume can vary, which will directly affect the expansion of long-term critical illness insurance business. However, PPP products (Huiminbao Insurance for instance) has a great chance to maintain its strong growth momentum. We must firmly grasp the market opportunities, and continue to deepen the distribution management, grasp the development trend of customer purchasing behavior, and actively explore new digital marketing models.

Transforming to One AXA

Empowered by our strong brand and supported by the sophisticated resources from Greater China, we are confident enough for a successful transformation despite the challenges on this journey, by working together towards the same goal, for we are united as one.

No progress is made without passion, and no transformation can be realized without your collective efforts. Dedication, devotion, courage and confidence – these are what will make a great debut of 3.0 Era of AXA Tianping, and what will ensure a smooth operation of this transformation journey.

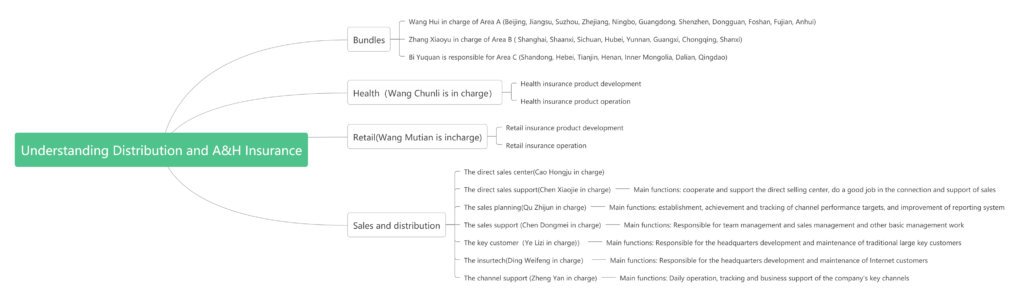

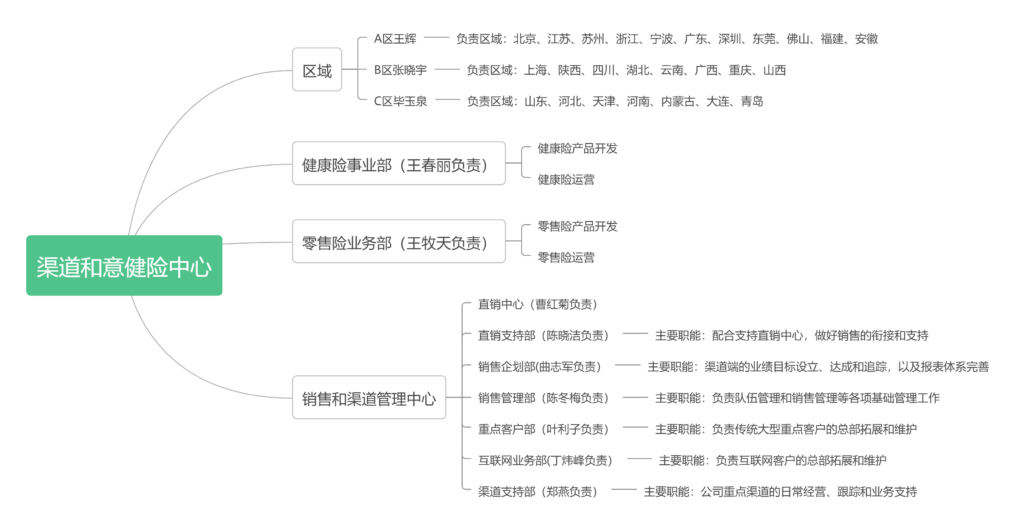

Understanding Distribution and A&H Insurance: