安盛天平再获标准普尔高评级与稳定展望

AXATP Received S&P Rating with “Stable Outlook”

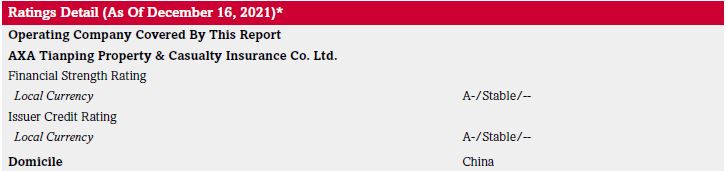

2021年12月16日,全球最具影响力的信用评级机构之一的标准普尔全球评级(S&P)发布了安盛天平的信用评级报告。安盛天平获得”A-“本币财务实力评级和发行人信用评级,评级展望为 “稳定”。

很自豪安盛天平再次获得全球评级机构标准普尔对公司财务实力和发行信用的高度认可,凭借安盛集团的持续投资、资源共享和战略支持,我们在中国市场展现出强劲的业务增长潜力和乐观前景。我们将继续依托安盛集团的国际经验与优势资源,深耕本土,在车险、健康险、商业险以及零售险领域,满足客户不断变化的需求,为更广泛的受众带來更多元化的优质产品和服务。

标普评级报告指出安盛天平为“中国最大的外资财险公司”,称安盛天平“在安盛的中国战略扩张中扮演着重要的角色”,且“获得来自母公司的长期投入”。“这体现在承保和精算专长、再保安排、风险管理及治理框架等各个领域。”

标普称“安盛天平在中国23个省份有200多个分支机构,能够触达全国80%以上的人口。这家位于中国的保险公司目标在2022-2023年以25%-30%的速度实现强劲的业务增长。该行业整体则预计将以个位数速度增长。”

On December 16, 2021, S&P Global Ratings (S&P), one of the most influential credit rating organizations in the world, issued a credit report rating AXA Tianping. We received “A-” local currency financial strength rating and issuer credit rating, with a “stable outlook”.

I feel very proud to be rated again by the global rating agency S&P, being recognized for our robust business growth prospect backed by the Group’s continuous investment and global resources and expertise. By leveraging all the support, we will strive to bring diverse and the most relevant products and services in motor, health, commercial and lifestyle and meet local customer’s evolving needs.

The S&P rating report overviews AXA Tianping as the “largest foreign-owned property and casualty (P&C) issuer in China. It “plays an important role in AXA’s strategic expansion in China”, with “long-term commitment of parental support”. “This is demonstrated in areas of underwriting and actuarial expertise, reinsurance arrangements, as well as risk-management and governance frameworks,” notes the rating agency.

S&P says that “AXA Tianping has over 200 branches in 23 provinces in China and can access more than 80% of the country’s population. The China-based insurer will likely target strong business growth at a pace of 25%-30% over 2022-2023, compared with single-digit prospective sector growth.”